Introduction

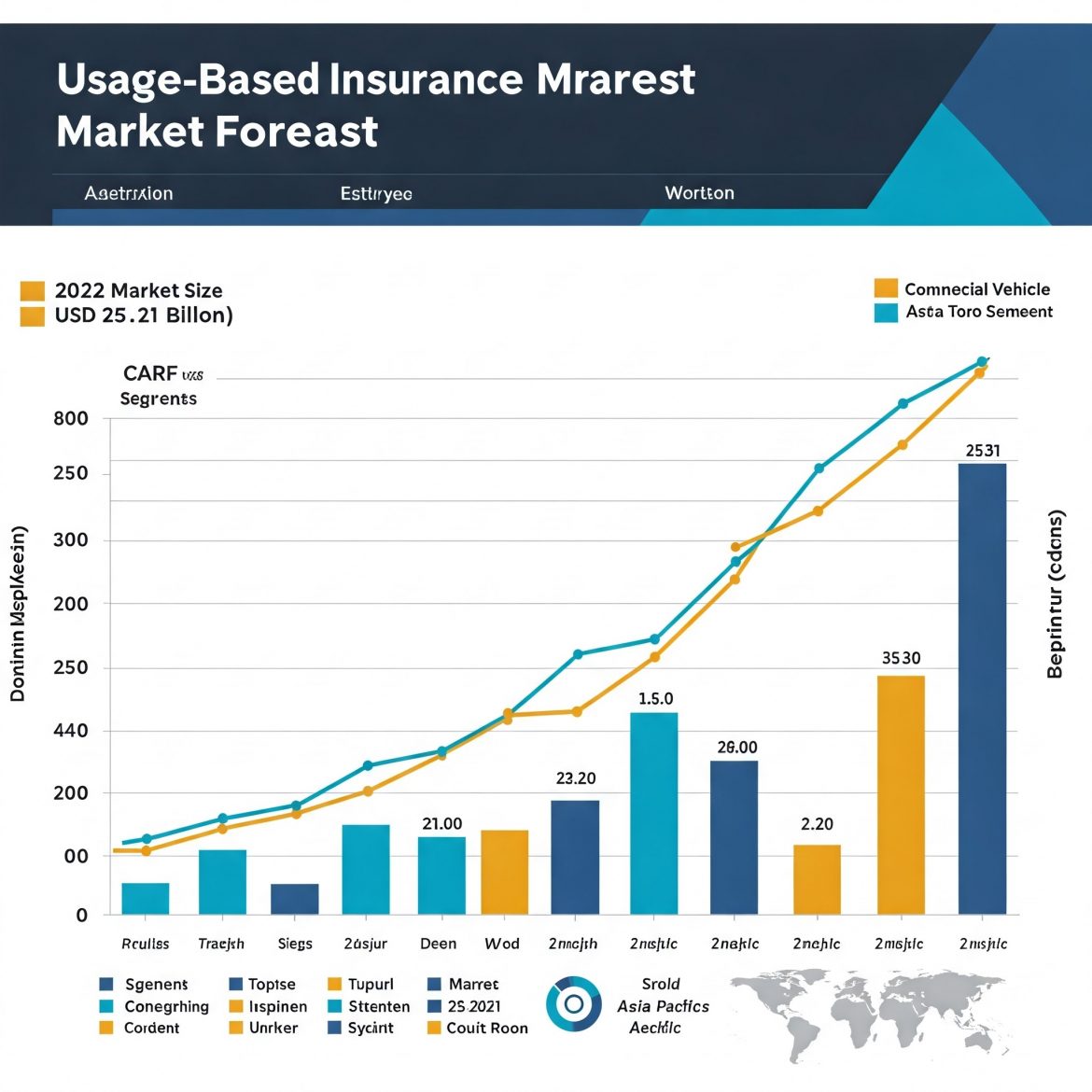

The global Usage-Based Insurance (UBI) market is witnessing significant growth, driven by advancements in telematics, changing consumer preferences, and the increasing adoption of connected vehicles. In 2022, the market was valued at USD 25.21 billion and is projected to expand at a CAGR of 26.32% through 2028. With insurers offering personalized policies based on driving behavior, UBI is revolutionizing the auto insurance industry, improving road safety, and ensuring fair premium pricing.

Market Trends

- Expansion Beyond Auto Insurance – UBI is no longer limited to vehicles; insurers are integrating telematics into home and health insurance, rewarding customers for risk-mitigating behaviors.

- Integration with Autonomous and Electric Vehicles – The adoption of electric and self-driving cars is influencing insurers to adjust risk assessment models, offering incentives for eco-friendly driving habits.

- Behavioral Analytics and Personalization – Insurers leverage AI-driven insights to tailor insurance offerings, ensuring customer-centric policies based on real-time data.

- Rise of Telematics as a Service (TaaS) – Cloud-based telematics solutions are making it easier for insurers to implement UBI without heavy technological investments.

𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐏𝐃𝐅 𝐒𝐚𝐦𝐩𝐥𝐞 𝐂𝐨𝐩𝐲 𝐨𝐟 𝐑𝐞𝐩𝐨𝐫𝐭: (𝐈𝐧𝐜𝐥𝐮𝐝𝐢𝐧𝐠 𝐅𝐮𝐥𝐥 𝐓𝐎𝐂, 𝐋𝐢𝐬𝐭 𝐨𝐟 𝐓𝐚𝐛𝐥𝐞𝐬 & 𝐅𝐢𝐠𝐮𝐫𝐞𝐬, 𝐂𝐡𝐚𝐫𝐭) @

👉https://www.marketinsightsresearch.com/request/download/9/56274/Usage-Based-Insurance-Market

Market Challenges

- Data Privacy Concerns – The collection of personal driving data raises security and privacy issues, requiring robust cybersecurity measures.

- High Initial Costs – Implementing telematics technology can be expensive, particularly for smaller insurance companies.

- Regulatory Hurdles – UBI adoption is subject to regional regulations, which can impact market expansion in certain areas.

Dominating & Fastest-Growing Regions

Dominating Region: Asia Pacific leads the global UBI market, fueled by rapid urbanization, increased vehicle ownership, and government support for telematics adoption.

Fastest-Growing Region: North America is experiencing rapid growth due to the rising adoption of connected cars, advancements in AI-driven analytics, and regulatory support for telematics-based policies.

𝗕𝘂𝘆 𝗡𝗼𝘄 𝗟𝗮𝘁𝗲𝘀𝘁 𝗘𝗱𝗶𝘁𝗶𝗼𝗻 𝗼𝗳 Global Usage-Based Insurance Market 𝗥𝗲𝗽𝗼𝗿𝘁

https://www.marketinsightsresearch.com/report/buy_now/9/56274/Usage-Based-Insurance-Market

Segmental Insights

Vehicle Type

- Passenger Cars – The largest segment due to increasing consumer demand for fair and flexible insurance pricing.

- Commercial Vehicles – The fastest-growing segment, as fleet operators seek cost-effective insurance solutions that promote driver safety.

Vehicle Age

- New Vehicles – Leading the market due to built-in telematics and seamless integration with UBI models.

- Used Vehicles – Gaining traction as insurers offer retrofitted telematics solutions for older cars.

Policy Type

- Pay-As-You-Drive (PAYD) – Charges policyholders based on the distance driven.

- Pay-How-You-Drive (PHYD) – Assesses premiums based on driving behavior, including acceleration, braking, and speed.

- Manage-How-You-Drive (MHYD) – Provides real-time feedback and coaching to improve driver habits.

𝗚𝗲𝘁 𝟭𝟬-𝟮𝟱% 𝗗𝗶𝘀𝗰𝗼𝘂𝗻𝘁 𝗼𝗻 𝗜𝗺𝗺𝗲𝗱𝗶𝗮𝘁𝗲 𝗽𝘂𝗿𝗰𝗵𝗮𝘀𝗲

https://www.marketinsightsresearch.com/request/discount/9/56274/Usage-Based-Insurance-Market

Regional Market Analysis

| Forecast Period | 2024-2028 |

| Market Size (2022) | USD 25.21 Billion |

| CAGR (2023-2028) | 26.32% |

| Fastest Growing Segment | Commercial Vehicle |

| Largest Market | Asia Pacific |

Key Market Players

- Cambridge Mobile Telematics

- Progressive Casualty Insurance Company

- Inseego Corp.

- The Floow Limited

- Assicurazioni Generali S.p.A

- Equitable Holdings, Inc.

- The Modus Group, LLC

- Octo Group S.p.A

- TomTom International BV

- Allianz Partners

Recent Developments

- State Farm expanded its UBI offerings in 2022, allowing more drivers to access personalized pricing and safe driving rewards.

- Progressive Corporation acquired Protective Insurance Corporation in 2021, strengthening its position in the UBI sector.

Conclusion

The global UBI market is on a strong growth trajectory, fueled by technological advancements and evolving consumer preferences. As insurers continue to refine data-driven risk assessment models, UBI is set to become a cornerstone of the insurance industry, offering personalized, fair, and cost-effective solutions for policyholders worldwide.