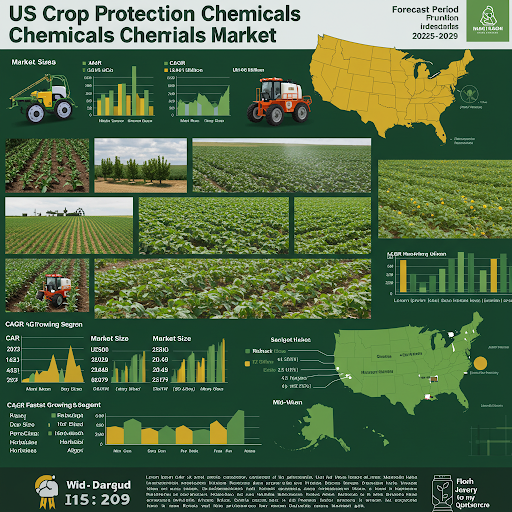

The US Crop Protection Chemicals Market is forecasted to arrive at USD 16.01 billion in 2023 and expand at a CAGR of 4.37% to arrive at USD 20.49 billion in 2029.

Market Overview

The Crop Protection Chemicals market in the United States is a major division of the agriculture sector. The U.S. is among the biggest markets for pesticides, fueled by its huge agricultural industry, the desire to optimize crop yield, and the growing menace of pests and diseases. The market is dominated by many domestic and foreign companies offering a range of crop protection products, from conventional synthetic pesticides to more sustainable biopesticides. In spite of all the controversies regarding the health and environmental effects of these chemicals, their effectiveness as pest control measures maintains their popularity.

𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐅𝐫𝐞𝐞 𝐒𝐚𝐦𝐩𝐥𝐞 𝐏𝐃𝐅 (Enter Corporate Email ID’ for a Free Sample Report):https://www.marketinsightsresearch.com/request/download/29/55696/united-states-crop-protection-chemicals-market

Adoption Of Integrated Pest Management Practices

In the United States, the implementation of Integrated Pest Management (IPM) practices has resulted in a complex relationship with the need for crop protection chemicals. IPM is a sustainable, science-driven strategy that integrates biological, cultural, physical, and chemical controls to manage pests in a manner that reduces economic, health, and environmental risks.

Though IPM focuses on minimizing dependence on chemical pesticides, it does not eliminate their use. Rather, it promotes the use of chemical interventions judiciously when the situation demands it, in conjunction with other forms of pest control. This harmonious approach to pest control provides efficient control while preventing possible adverse effects on human health and the environment.

In spite of the focus on non-chemical approaches, crop protection chemicals continue to be a part of most IPM programs. The chemicals are an important tool in the fight against persistent pests, particularly when other alternatives fall short. The selective use of specific chemicals within an IPM program is considered a realistic strategy to effectively reduce crop damage.

Consequently, the importance of sustainable and integrated methods by the agricultural industry has catalyzed innovations in formulation and application technology. The dynamic of the pest control environment within the United States is a complex balance between the trend of adopting integrated methods and the ongoing need for crop protection chemicals that are consistent with the practices of sustainability and responsible environmental stewardship.

Key Market Trends

Growing Use of Biologicals & Biopesticides

The United States Crop Protection Chemicals Market is going through a significant transition towards biological and biopesticide adoption with rising environmental considerations and an elevated focus on environmentally friendly agricultural methodologies. Biologicals, including advantageous microorganisms and naturally occurring chemical substances, are becoming increasingly high-profile as nature-friendly substitutes to conventional chemical-based pesticides. Such a shift signals a tactical push towards integrated pest management (IPM) mechanisms that balance farming productivity with protection of the environment.

Farmers are now more and more incorporating biopesticides into their pest control regimes, appreciating their efficacy and lower environmental footprint. For example, the U.S. Department of Agriculture’s Agricultural Research Service (ARS) has created a bacteria-based biopesticide, “Grandevo,” which manages pecan weevil infestations without harming beneficial natural enemies and while helping control pecan aphids. This biopesticide presents an environmentally friendly alternative to chemical insecticides and is consistent with sustainable agriculture practices.

The use of biologicals and biopesticides is a sign of a larger commitment in the agricultural industry to sustainability and responsible stewardship. This change not only decreases chemical use and environmental impact but also reframes agricultural practice to focus on long-term viability and resilience. With growing environmental regulations and consumer interest in organic and sustainably sourced food, the adoption of biologicals and biopesticides is projected to go on an upward growth path, remaking the future of crop protection in the United States.

Formulation and Delivery System Development

Formulation and delivery system innovation is a key and persistent trend in the United States Crop Protection Chemicals Market. With the increasing need for sustainable and eco-friendly solutions, companies are significantly investing in massive research and development activities. The aim is to develop new formulations that not only improve the efficacy of active ingredients but also reduce their environmental footprint.

Key Market Players

- BASF SE

- The Dow Chemical Company

- DuPont de Nemours, Inc.

- Sumitomo Chemical America, Inc.,

- Syngenta Crop Protection AG

- Bayer CropScience LLC

- FMC Corporation

- Corteva Agriscience

- Nufarm Americas Inc.

- Valent BioSciences LLC

| By Type | By Origin | By Form | By Mode of Application | By Region |

|

|

|

|

|

Segmental Insights

Type Insights

Herbicides emerged as

Origin Insights

According to the Origin, Biopesticides was the leading segment within the United States

Download Free Sample Report

Regional Insights

The Mid-West became the leading region in the United States Crop Protection Chemicals Market in 2023, with the highest market share. This is