Introduction

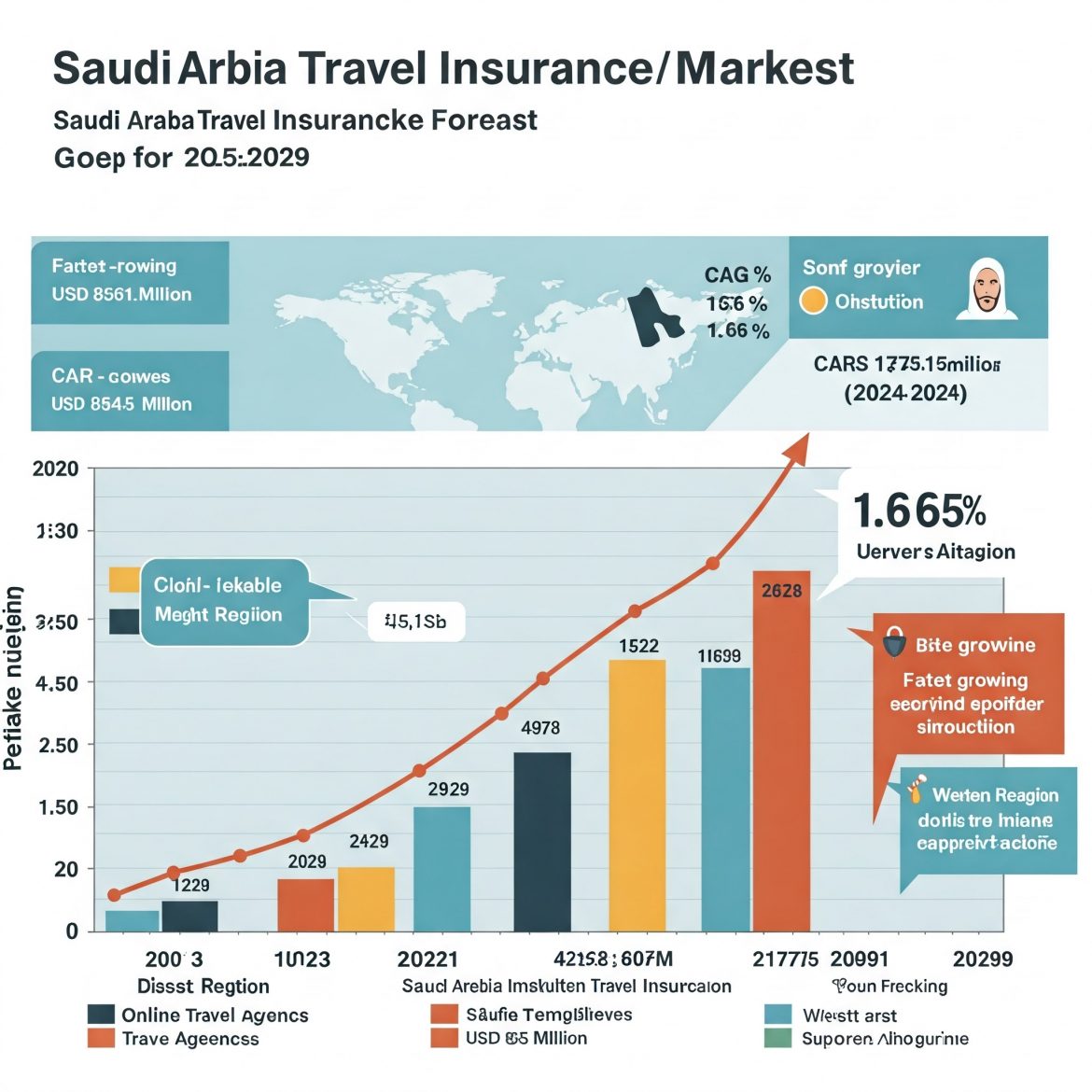

The Saudi Arabia travel insurance market, valued at USD 856.15 million in 2023, is projected to reach USD 2,178.75 million by 2029, growing at a CAGR of 16.65%. This rapid expansion is fueled by increasing international tourism, digitalization of insurance services, and government initiatives under Vision 2030. The growing number of travelers, especially for Hajj and Umrah pilgrimages, alongside rising awareness of travel-related risks, is driving significant demand for customized insurance products.

Market Trends

- Digital Transformation & Online Travel Insurance Growth

Online travel agencies are the fastest-growing segment, offering seamless digital policy purchases. - Surge in Pilgrimage-Related Insurance

High demand for Hajj and Umrah travel insurance is driving tailored policies that cover medical emergencies and trip disruptions. - Personalized & Flexible Insurance Plans

Insurers are developing customized policies for business travelers, students, and family travelers, catering to diverse needs. - Rise of Mobile Payments & E-Wallets

Consumers are increasingly opting for digital payments, with e-wallets and card payments dominating transactions.

𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐏𝐃𝐅 𝐒𝐚𝐦𝐩𝐥𝐞 𝐂𝐨𝐩𝐲 𝐨𝐟 𝐑𝐞𝐩𝐨𝐫𝐭: (𝐈𝐧𝐜𝐥𝐮𝐝𝐢𝐧𝐠 𝐅𝐮𝐥𝐥 𝐓𝐎𝐂, 𝐋𝐢𝐬𝐭 𝐨𝐟 𝐓𝐚𝐛𝐥𝐞𝐬 & 𝐅𝐢𝐠𝐮𝐫𝐞𝐬, 𝐂𝐡𝐚𝐫𝐭) @

👉https://www.marketinsightsresearch.com/request/download/9/56202/Saudi-Arabia-Travel-Insurance-Market

Market Challenges

- Regulatory Compliance: Adapting to evolving insurance laws in Saudi Arabia.

- Cybersecurity Risks: Ensuring data protection in digital insurance platforms.

- Consumer Awareness: Educating travelers on the benefits of comprehensive travel insurance.

Regional Analysis

| Region | Market Size (2023) | CAGR (2024-2029) | Key Insights |

| Western | Largest Market | 16.4% | High pilgrimage traffic & demand for Hajj and Umrah insurance |

| Eastern | USD 320 Million | 15.8% | Growth in business & leisure travel insurance adoption |

| Northern & Central | USD 280 Million | 14.9% | Expansion of domestic tourism fueling demand |

Segmental Insights

Trip Type

- Inbound Travel Insurance: Dominates due to high demand from international visitors for pilgrimage and business trips.

- Hajj & Umrah Travel Insurance: A key driver of the market with dedicated policies for religious travelers.

Mode of Purchase

- Online Travel Agencies: Fastest-growing due to the convenience of digital platforms.

- Banks & Airlines: Traditional purchase channels remain relevant for bundled travel insurance offers.

Mode of Payment

- Card Payments & E-Wallets: Leading digital payment methods for travel insurance purchases.

- Bank Transfers & Other Online Payments: Expanding with the growth of fintech solutions.

𝗕𝘂𝘆 𝗡𝗼𝘄 𝗟𝗮𝘁𝗲𝘀𝘁 𝗘𝗱𝗶𝘁𝗶𝗼𝗻 𝗥𝗲𝗽𝗼𝗿𝘁

https://www.marketinsightsresearch.com/report/buy_now/9/56202/Saudi-Arabia-Travel-Insurance-Market

Key Players

- Tawuniya Insurance Company

- Al-Rajhi Company for Cooperative Insurance

- Allianz Saudi Fransi Cooperative Insurance Company

- Gulf Insurance Group (GIG)

- Arabian Shield Cooperative Insurance Company

- LIVA Insurance Company

- SALAMA Cooperative Insurance Company

𝗚𝗲𝘁 𝟭𝟬-𝟮𝟱% 𝗗𝗶𝘀𝗰𝗼𝘂𝗻𝘁 𝗼𝗻 𝗜𝗺𝗺𝗲𝗱𝗶𝗮𝘁𝗲 𝗽𝘂𝗿𝗰𝗵𝗮𝘀𝗲

https://www.marketinsightsresearch.com/request/discount/9/56202/Saudi-Arabia-Travel-Insurance-Market

Conclusion

The Saudi Arabia travel insurance market is witnessing remarkable growth, driven by technological advancements, increased travel demand, and evolving consumer preferences. With the rise of digital insurance platforms and customized policies, the industry is set to play a crucial role in Saudi Arabia’s expanding tourism sector.