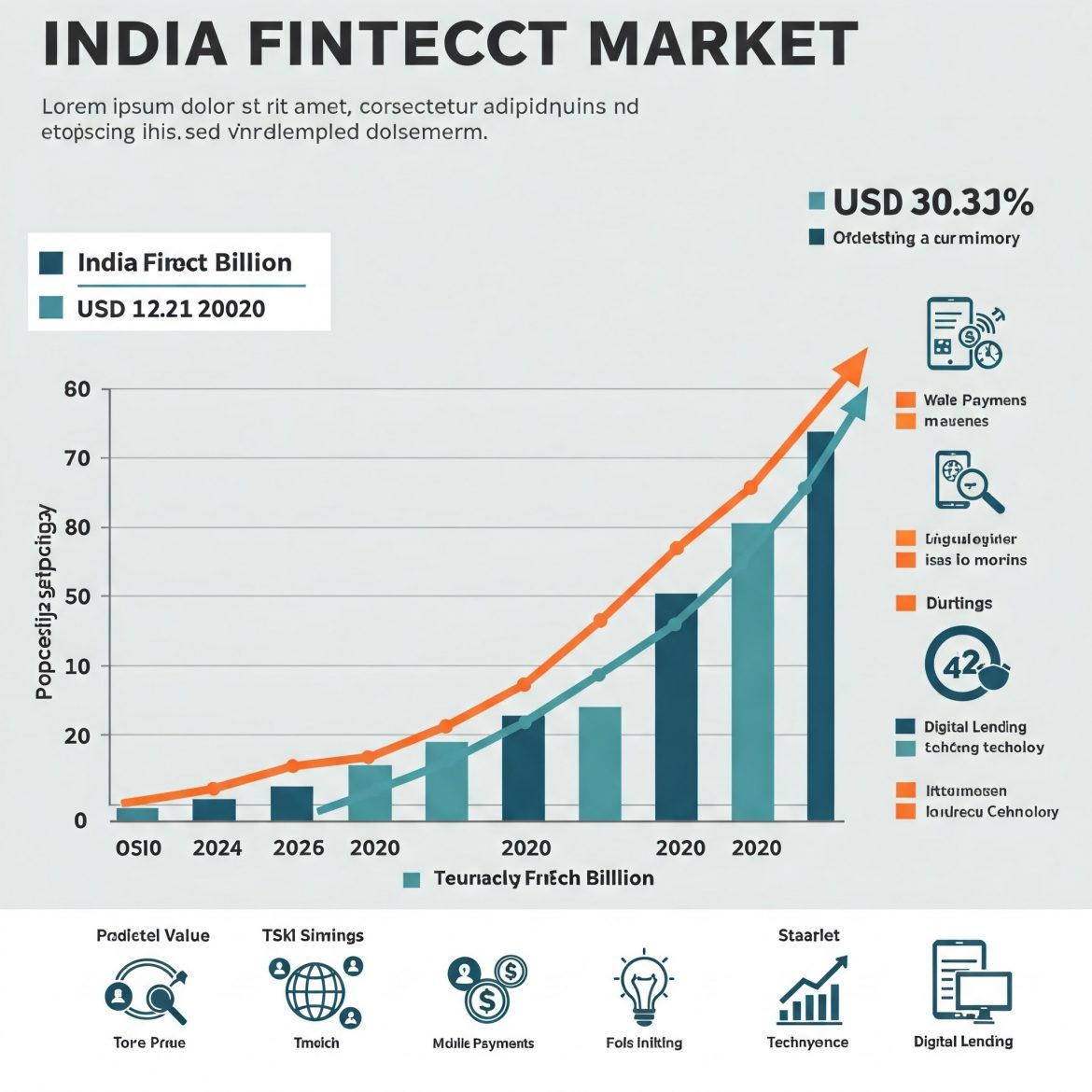

The India FinTech market is experiencing unprecedented growth, fueled by advancements in digital payment technologies, evolving consumer preferences, and a surge in financial inclusion. With a market value of USD 112.75 billion in 2024, this sector is projected to reach USD 550.21 billion by 2030, growing at an impressive CAGR of 30.31% during the forecast period. The rapid expansion of PayTech, InsurTech, LendTech, and WealthTech is transforming India’s financial ecosystem, making it one of the fastest-growing FinTech markets globally.

Market Trends

The India FinTech market is witnessing an evolution driven by digitalization, increasing smartphone penetration, and government-led financial initiatives. The introduction of UPI, Bharat QR, and the rise of digital wallets have significantly boosted the adoption of cashless transactions. According to the National Payments Corporation of India (NPCI), over 74 billion UPI transactions worth USD 1.52 trillion were recorded in 2022, reflecting the rapid transition towards a digital-first economy.

𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐏𝐃𝐅 𝐒𝐚𝐦𝐩𝐥𝐞 𝐂𝐨𝐩𝐲 𝐨𝐟 𝐑𝐞𝐩𝐨𝐫𝐭: (𝐈𝐧𝐜𝐥𝐮𝐝𝐢𝐧𝐠 𝐅𝐮𝐥𝐥 𝐓𝐎𝐂, 𝐋𝐢𝐬𝐭 𝐨𝐟 𝐓𝐚𝐛𝐥𝐞𝐬 & 𝐅𝐢𝐠𝐮𝐫𝐞𝐬, 𝐂𝐡𝐚𝐫𝐭) @

👉

https://www.marketinsightsresearch.com/request/download/9/56320/India-FinTech-Market

The rise of neobanks is another key trend reshaping the market. By offering seamless banking experiences without physical branches, companies like Jupiter, Fi, and Niyo are bridging the gap between traditional banking and modern digital financial solutions. Additionally, AI-driven innovations in lending and insurance technology are enhancing risk assessment and fraud detection, further strengthening the FinTech ecosystem.

Market Challenges

Despite its rapid growth, the India FinTech market faces several challenges. Data security and privacy concerns remain a major issue, with cyber threats and fraud posing risks to digital transactions. Regulatory hurdles, including stringent RBI guidelines and lengthy approval processes, can slow down market expansion. Additionally, financial literacy remains low in rural areas, limiting the widespread adoption of FinTech solutions beyond metropolitan cities.

𝗕𝘂𝘆 𝗡𝗼𝘄 𝗟𝗮𝘁𝗲𝘀𝘁 𝗘𝗱𝗶𝘁𝗶𝗼𝗻 𝗼𝗳 India FinTech Market

https://www.marketinsightsresearch.com/report/buy_now/9/56320/India-FinTech-Market

Dominating Region

The western region, particularly Maharashtra, remains the dominant force in India’s FinTech sector, owing to its status as the financial capital of the country. Cities like Mumbai and Pune serve as hubs for leading FinTech startups and established financial institutions, driving innovation and investment in digital financial services.

Fastest-Growing Region

The southern region, including Bangalore, Hyderabad, and Chennai, is emerging as the fastest-growing FinTech market in India. Home to a thriving startup ecosystem, this region is attracting significant venture capital investments, fostering growth in digital payments, neobanking, and blockchain-based financial solutions.

𝗚𝗲𝘁 𝟭𝟬-𝟮𝟱% 𝗗𝗶𝘀𝗰𝗼𝘂𝗻𝘁 𝗼𝗻 𝗜𝗺𝗺𝗲𝗱𝗶𝗮𝘁𝗲 𝗽𝘂𝗿𝗰𝗵𝗮𝘀𝗲

https://www.marketinsightsresearch.com/request/discount/9/56320/India-FinTech-Market

Future Opportunities & Market Growth

The India FinTech market is poised for exponential growth, backed by increasing middle-class income levels and rising internet penetration. The government’s initiatives, such as Pradhan Mantri Jan Dhan Yojana (PMJDY) and the ‘Startup India’ movement, are paving the way for broader financial inclusion and technological adoption. By 2030, India is expected to add 140 million middle-class and 21 million high-income households, presenting a massive opportunity for FinTech companies to expand their customer base.

Furthermore, the expansion of FinTech services into tier-II and tier-III cities is expected to drive future growth. Currently, over 70% of India’s population resides in rural areas, yet FinTech adoption remains concentrated in urban regions. Bridging this gap through financial literacy programs and localized digital solutions will be crucial in unlocking the full potential of the market.

Recent Developments & Investments

- UPI Expansion for NRIs – In January 2023, NPCI announced that NRIs from ten countries, including the U.S., U.K., and UAE, can now use UPI services without an Indian mobile number, increasing international adoption.

- Paytm’s G20 Initiative – Paytm launched a special G20-themed QR code in February 2023, reinforcing India’s dominance in mobile payments.

- Razorpay’s Acquisition of Ezetap – Razorpay expanded its portfolio by acquiring Ezetap, strengthening its presence in the online point-of-sale payments sector.

- Funding Surge – India ranked third globally in FinTech funding, with startups raising approximately USD 5 billion in 2022, reflecting strong investor confidence.

Conclusion

The India FinTech market is on an accelerated growth trajectory, fueled by digital innovation, government support, and shifting consumer preferences. As PayTech, InsurTech, LendTech, and WealthTech continue to evolve, the market presents vast opportunities for both startups and established players. While challenges such as regulatory hurdles and cybersecurity threats persist, the overall outlook remains highly optimistic, with the market set to achieve remarkable milestones by 2028.