AI Avatars Market Poised for Rapid Growth Amid Digital Transformation

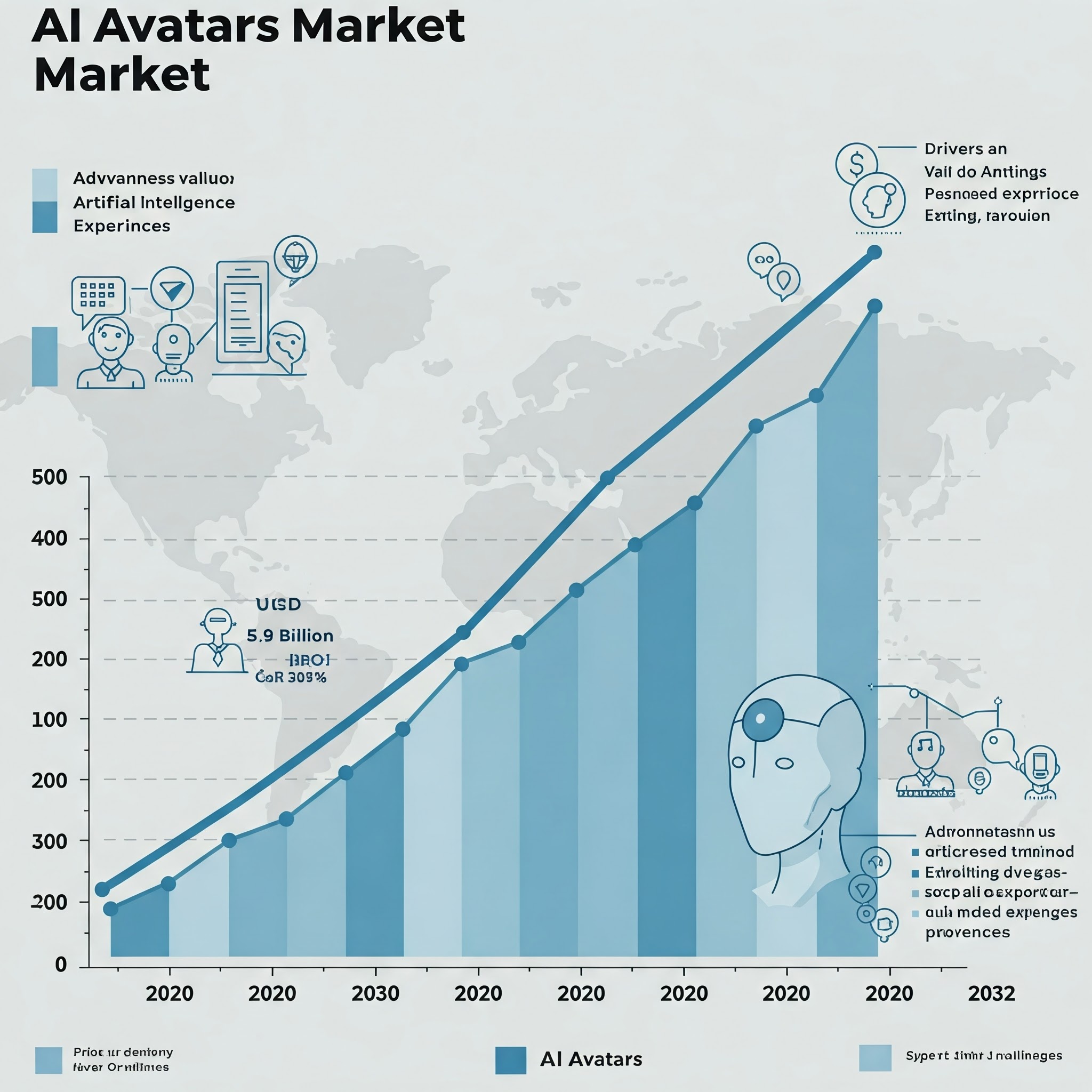

The AI avatars market is expanding at an unprecedented rate, driven by increasing demand for virtual assistants, digital influencers, and interactive customer engagement solutions. Valued at USD 5.9 billion in 2023, the market is projected to grow at a CAGR of over 30% from 2024 to 2032, reaching an estimated USD 57.9 billion. This surge is fueled by advancements in AI, natural language processing (NLP), and machine learning (ML), along with shifting consumer preferences for digital interaction.

Key Market Trends

- Rise of AI-Powered Virtual Assistants

Businesses across retail, healthcare, and finance are integrating AI avatars to enhance customer service, automate responses, and create personalized experiences. - Adoption in Education & Training

AI avatars are revolutionizing virtual learning by offering personalized tutoring, real-time feedback, and immersive learning experiences in multiple languages. - Emergence of Virtual Influencers

Brands are leveraging AI-generated influencers for marketing campaigns, product promotions, and interactive engagement, reshaping social media advertising.

𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐏𝐃𝐅 𝐒𝐚𝐦𝐩𝐥𝐞 𝐂𝐨𝐩𝐲 𝐨𝐟 𝐑𝐞𝐩𝐨𝐫𝐭: (𝐈𝐧𝐜𝐥𝐮𝐝𝐢𝐧𝐠 𝐅𝐮𝐥𝐥 𝐓𝐎𝐂, 𝐋𝐢𝐬𝐭 𝐨𝐟 𝐓𝐚𝐛𝐥𝐞𝐬 & 𝐅𝐢𝐠𝐮𝐫𝐞𝐬, 𝐂𝐡𝐚𝐫𝐭) @

👉https://www.marketinsightsresearch.com/request/download/8/630/AI-Avatars-Market

Market Challenges

- Legal & Ethical Concerns

The rise of AI-generated avatars raises privacy, copyright, and deepfake-related challenges, leading to increased scrutiny from regulators. - Infrastructure & Integration Issues

Businesses adopting AI avatars face challenges in compatibility with existing IT ecosystems, requiring advanced computing power and seamless cloud deployment.

Regional Insights

- Dominating Region: North America leads due to early AI adoption, strong tech infrastructure, and major investments by industry leaders.

- Fastest-Growing Region: Asia-Pacific is expected to grow rapidly, fueled by rising adoption of AI avatars in gaming, e-commerce, and customer service industries.

Leading Companies in the AI Avatars Market

- NVIDIA

- Microsoft

- Meta

- IBM

- Anthropic

- UiPath

Industry News & Recent Developments

- June 2024: TikTok launched AI-generated digital avatars to help content creators and brands produce customized, multilingual promotional videos.

- February 2024: MIT partnered with EDUCSIM to develop a virtual AI avatar of Dr. Benjamin Warf, enabling remote medical training for professionals worldwide.

𝗕𝘂𝘆 𝗡𝗼𝘄 𝗟𝗮𝘁𝗲𝘀𝘁 𝗘𝗱𝗶𝘁𝗶𝗼𝗻 𝗥𝗲𝗽𝗼𝗿𝘁

https://www.marketinsightsresearch.com/report/buy_now/8/630/AI-Avatars-Market

Market Overview Table

| Report Attribute | Details |

| Base Year | 2023 |

| Market Size in 2023 | USD 5.9 Billion |

| Forecast Period | 2024 – 2032 |

| CAGR (2024-2032) | 30% |

| 2032 Value Projection | USD 57.9 Billion |

| Historical Data | 2021 – 2023 |

| No. of Pages | 240 |

| Tables, Charts & Figures | 360 |

| Segments Covered | Avatar, Deployment, Technology, Application, Industry Vertical |

Market Segmentation

Avatar Type:

- Interactive Digital Human Avatar

- Non-Interactive Digital Human Avatar

Deployment Model:

- Cloud-Based

- On-Premises

Technology:

- Natural Language Processing (NLP)

- Computer Vision

- Machine Learning

- Artificial Intelligence (AI)

Application:

- Virtual Agents & Assistants

- Virtual Influencers

- Virtual Characters

- Virtual Companions

Industry Vertical:

- Retail & E-commerce

- Healthcare

- Education

- Banking, Financial Services & Insurance (BFSI)

- Gaming & Entertainment

- Automotive

- Telecommunications

𝗚𝗲𝘁 𝟭𝟬-𝟮𝟱% 𝗗𝗶𝘀𝗰𝗼𝘂𝗻𝘁 𝗼𝗻 𝗜𝗺𝗺𝗲𝗱𝗶𝗮𝘁𝗲 𝗽𝘂𝗿𝗰𝗵𝗮𝘀𝗲

https://www.marketinsightsresearch.com/request/discount/8/630/AI-Avatars-Market

Conclusion

The AI avatars market is set to revolutionize digital interaction, customer engagement, and virtual assistance across industries. With continuous AI advancements, increasing adoption of digital avatars, and the expansion of metaverse applications, this market is expected to see exponential growth in the coming years.