MIR is pleased to announce the launch of its latest report, “Green Hydrogen Market.” In this detailed study, it has been found that the global Green Hydrogen market, which was worth USD 4.9 billion in 2024, is growing steadily and is expected to reach USD 83.43 billion by 2035. This growth is in line with a strong CAGR of 40.63% during the forecast period of 2025-2035.

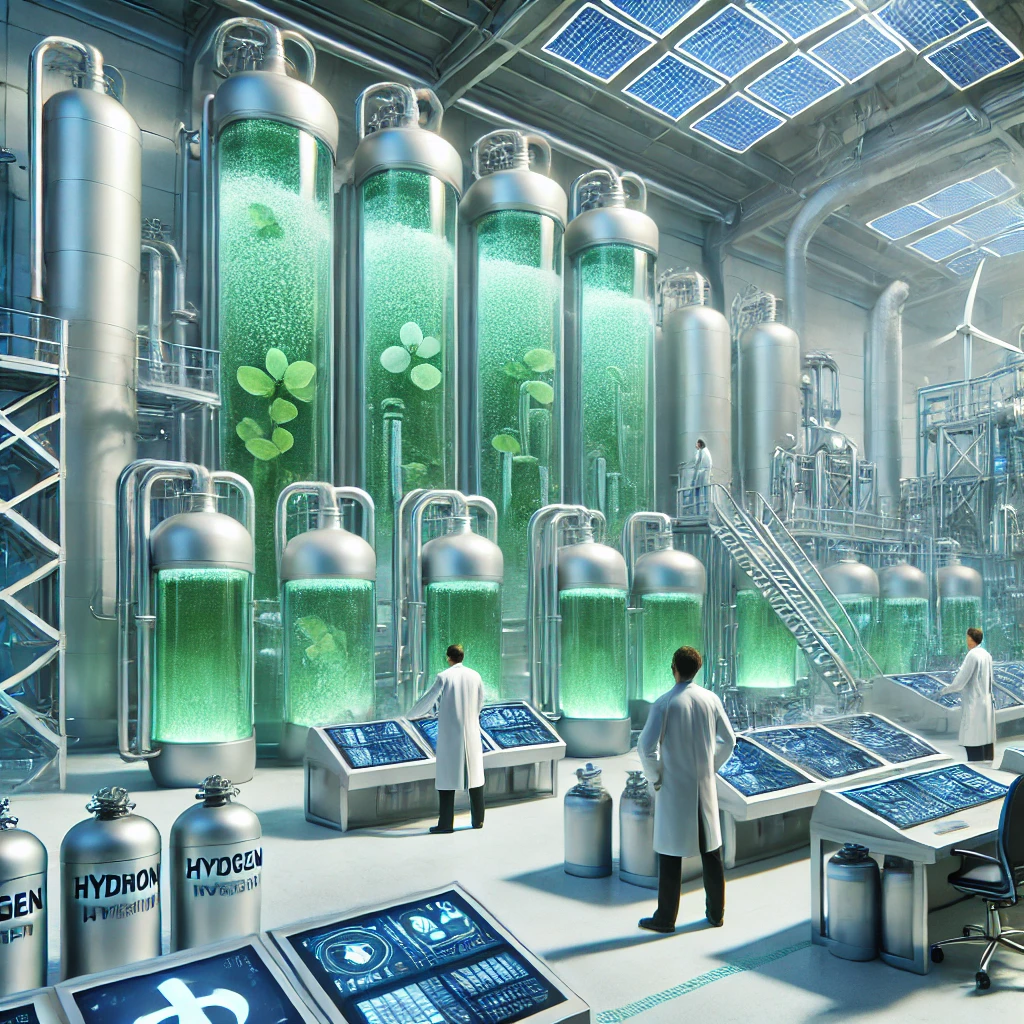

Green hydrogen is a clean energy source produced by splitting water using electricity from renewable energy sources like wind or solar. This method significantly reduces greenhouse gas emissions in comparison to traditional hydrogen production based on fossil fuels

Click here to get a FREE SAMPLE REPORT

Development of Alkaline Electrolysis Process Fueling Market Growth

The creation of the Alkaline Electrolysis Process of green hydrogen production is expected to drive the uptake of green hydrogen across various industries. In Alkaline Electrolysis Process, a liquid solution of an electrolyte like potassium hydroxide or sodium hydroxide and water is utilized. Hydroxide ions move across the electrolyte from the cathode to the anode of each cell when electric current is supplied to the stack of the electrolysis cell, generating hydrogen and oxygen gas bubbles on the cathode and anode sides of the electrolyze, respectively. The green hydrogen generated is of high purity, and the extensive & inexpensive availability of electrolyte solutions renders it an appropriate means of green hydrogen production. Numerous corporations are investing in the production of green hydrogen by the Alkaline Electrolysis Process. For example, in July 2021, Hyundai Motor Company and Kia Corporation have entered into a memorandum of understanding with Next Hydrogen Corporation, a Canadian corporation that has expertise in water electrolysis technology to create a next-generation alkaline water electrolysis system for the economic production of green hydrogen and new business opportunities.

Application of Green Hydrogen in Power Systems is Assisting in Propelling Global Green Hydrogen Market

Power systems require greater flexibility since Variable Renewable Energy (VRE) share is increasing very fast in various markets across the globe. The electrolytic cells utilized to create green hydrogen can be built as a flexible power source that can be quickly scaled up or down to offset VRE production fluctuations by responding to electricity prices. Green hydrogen can be stored over long durations and can be utilized when VRE is not available for power generation in stationary fuel cells or hydrogen-fueled gas turbines. Thus, green hydrogen facilitates network integration with higher shares of VRE, enhancing system efficiency and profitability, which has seen increased application of green hydrogen in power systems

Use of Proton Exchange Membrane (PEM) Electrolyzer

The Proton Exchange Membrane (PEM) Electrolysis Process is another technology that is becoming increasingly popular in the Global Green Hydrogen Market. PEM electrolyzers utilize a proton exchange membrane and a solid polymer electrolyte. Water is split into hydrogen and oxygen when current is introduced to the battery, and the hydrogen protons pass through the membrane to produce hydrogen gas on the cathode side. The PEM electrolysis-produced green hydrogen is of premium quality and the rapid response time suits it to supply grid balancing services. Therefore, numerous industrial gas companies are venturing into green hydrogen production. For instance, Linde plc in January 2021 announced that it will construct own, and operate the globe’s biggest PEM electrolyzer plant at Leuna Chemical Complex in Germany. Furthermore, in July 2021, Shell commenced operations at purportedly Europe’s biggest PEM green hydrogen electrolyzer at Shell’s Energy and Chemicals Park in Rhineland, Germany.

Drivers, Opportunities & Restraints

The industry is growing fast with a number of drivers. One key driver is that there is a massive global drive to cut carbon emissions, leading to mounting government backing and investment in renewable energy technology and infrastructure for the production of green hydrogen.

The green hydrogen market holds huge opportunities based on a number of factors. As the world pursues net-zero emissions, nations are spending more on the production of green hydrogen as a source of clean energy. India, for example, is working towards becoming a dominant player in this industry with a five million metric tons annual production capacity by 2030, backed by huge government funding and incentives.

The industry is exposed to a range of major obstacles that may adversely affect its progress. The leading problem is production cost, and current processes, especially electrolysis, are very much more expensive than traditional methods of hydrogen manufacture, with each estimated at approximating USD 10.3 per kg vs. USD 1.5-2.3 per kg for fossil-based processes.

Technology Insights

On the basis of technology, alkaline electrolyzer dominated the market with the highest revenue share of 65.46% in 2024. Alkaline electrolyzer employs a liquid alkaline solution of potassium or sodium hydroxide as its electrolyte and it has more operating hours compared to PEM electrolyzers.

Yet, alkaline electrolyzers are less in power and current density with 100 to 105 degree Celsius operational range compared to 70 to 90-degree Celsius ranges of PEM electrolyzers. Additionally, alkaline electrolyzes are likely to experience growth due to availability at low cost compared to PEM electrolyzers.

PEM electrolyzers will see a better growth rate in the forecast period. Solid specialty plastic material-based electrolytes have the ability to provide superior functional flexibility to the PEM electrolyzer when compared with the alkaline version. High proton conductivity, low gas permeability, and reduced proton exchange membrane thickness are reasons why significant growth will occur.

Key Manufacturers

These are the significant players and companies in a given industry or sector that have great influence on its dynamics. Knowing these key figures is essential for understanding competitive positioning, market tendencies, and strategic possibilities.

- Siemens Energy (Germany)

- Nel ASA (Norway)

- Plug Power Inc. (United States)

- ITM Power PLC (United Kingdom)

- McPhy Energy S.A. (France)

- Ballard Power Systems (Canada)

- Cummins Inc. (United States)

- Linde plc (United Kingdom)

- ENGIE SA (France)

- Kawasaki Heavy Industries, Ltd. (Japan)

- Hydrogenics (Canada)

- Air Liquide (France)

- Thyssenkrupp AG (Germany)

- Statoil (Norway)

- Shell plc (Netherlands)

- Enel S.p.A. (Italy)

- Fortescue Future Industries (Australia)

- H2One (Australia)

- Acteon (France)

- WorleyParsons (Australia) and Other Key Players

- Technology Outlook (Volume, Kilotons, Revenue

- Alkaline Electrolyzer

- Polymer Electrolyte Membrane (PEM) Electrolyzer

- SOEC Electrolyzer

- Application Outlook (Volume, Kilotons, Revenue

- Power Generation

- Transport

- Others

- Distribution Channel Outlook (Volume, Kilotons, Revenue

- Pipeline

- Cargo

BUY TODAY THIS EXCLUSIVE REPORT WITH 2 YEARS SERVICE

Germany Green Hydrogen Market Trends

The Green Hydrogen market of Germany plays an important role in the European market based on the focus of the country on renewable integration and grid modernization. Germany, being at the forefront of wind and solar power generation, needs efficient and strong Green Hydrogens for guaranteed transmission of power from renewable to the grid. The market is marked by continuous investments in offshore wind farms and smart grid projects, which are major drivers of Green Hydrogen demand.

UK Green Hydrogen Market Trends

The UK green hydrogen market is influenced by a number of major factors that highlight sustainability and energy independence. One of the major drivers is the government’s focus on net-zero carbon emissions by 2050, which has resulted in developing an overall Hydrogen Strategy for increasing production and infrastructure. These involve heavy investment in electrolytic hydrogen production and CCUS technology, complemented by funding plans that incentivize private investment in hydrogen schemes.

Asia Pacific Green Hydrogen Market Trends

The Asia Pacific green hydrogen industry is set to register tremendous growth owing to a convergence of aggressive decarbonization objectives, heavy spending on renewable power, and escalating demand for alternative clean fuels. Regional nations, including Australia, Japan, and South Korea, are giving the highest priority to green hydrogen as a central piece of their energy policies to help cut carbon emissions and improve energy security. The construction of large-scale green hydrogen plants and partnerships among local and global firms further support this market.

China Green Hydrogen Market Trends

The expansion of China’s green hydrogen market is prompted by some significant drivers, all of which correspond with the ambitious energy and environmental objectives of China. Chief among them is robust government leadership on decarbonization backed up by policies encouraging reduction of carbon emissions and increased adoption of renewable power. Low-cost abundant renewable electricity in China from solar and wind, which drives the economic production of green hydrogen competitively in relation to fossil fuels, is another leading driver.

Japan Green Hydrogen Market Trends

The green hydrogen market in Japan is underpinned by high government backing, aggressive goals for hydrogen production, and a thrust for embracing clean energy solutions in multiple industries. The Japanese government has adopted an overarching hydrogen strategy to achieve carbon neutrality by 2050 that includes visions of boosting green hydrogen production in the coming years significantly, reaching about 3 million tons by 2030 and up to 20 million tons by 2050.

Central & South America Green Hydrogen Market Trends

The Central and South America green hydrogen market is dominated by its rich renewable energy sources, solar and wind, placing the region on the cusp of becoming a clean hydrogen leader. Chile, Brazil, and Colombia are the leaders, rolling out national strategies to tap the potential and projecting ambitious production figures in the years to come. The area boasts more than 140 green hydrogen projects at different stages of development, demonstrating increasing political will and investment appetite.