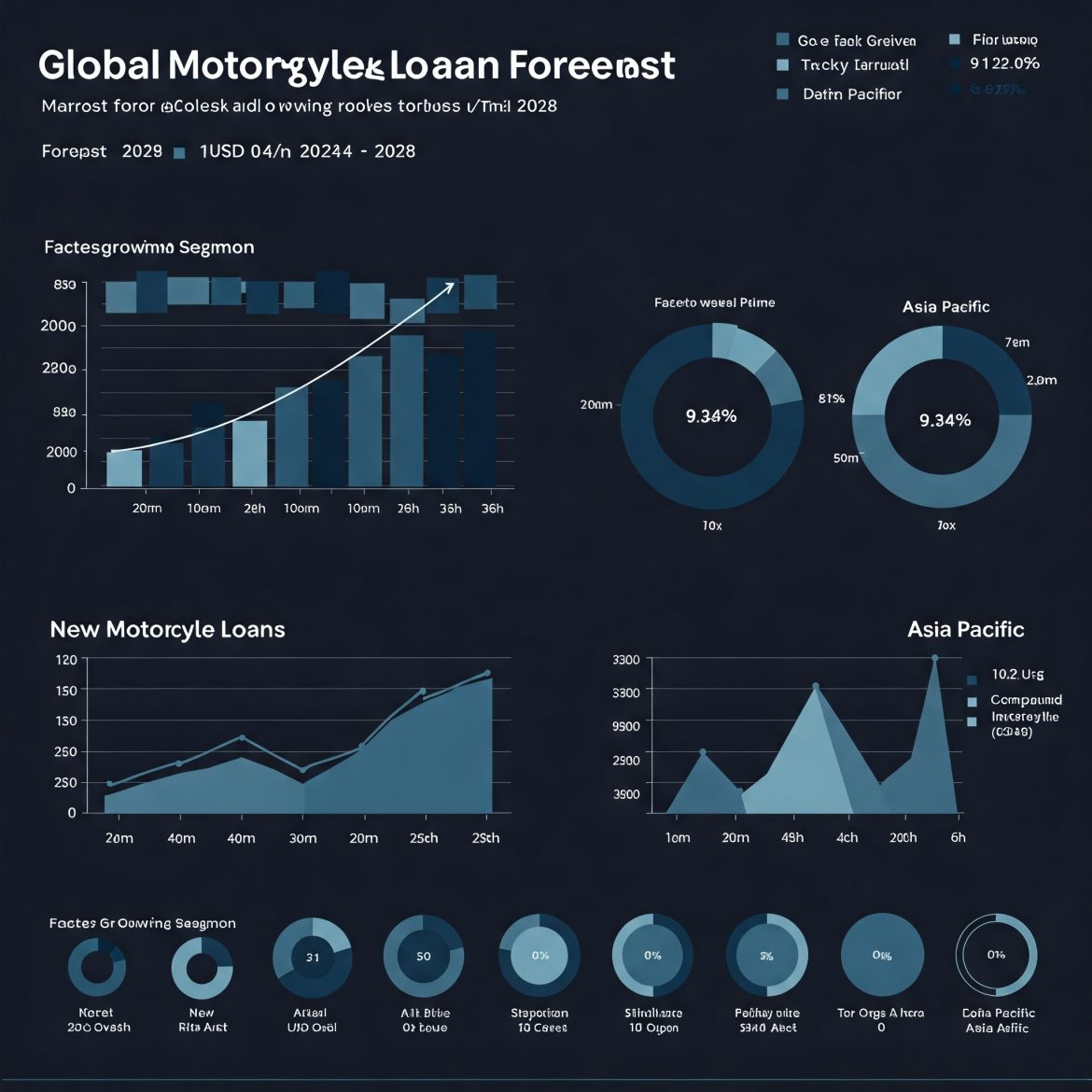

The global motorcycle loan market is experiencing significant growth, driven by increasing demand for motorcycles and evolving financing options. With a projected CAGR of 9.34% through 2028, the market is fueled by advancements in digital lending platforms, innovative loan structures, and shifting consumer preferences towards affordable and flexible financing solutions.

Market Trends

- Rising Demand for Motorcycles – The growing preference for motorcycles, especially in developing regions, is boosting the demand for motorcycle loans. Urbanization and traffic congestion drive consumers to opt for two-wheelers as an economical mode of transport.

- Expansion of Digital Lending – Financial institutions and fintech companies are leveraging technology to streamline loan approvals, making financing more accessible and convenient.

- Increased Adoption of Electric Motorcycles – The rise of eco-friendly electric motorcycles is reshaping the lending landscape, with lenders offering customized financing solutions for sustainable mobility.

Market Challenges

- Economic Volatility – Fluctuations in economic conditions impact consumer borrowing capacity, affecting loan demand and repayment rates.

- Regulatory Compliance – Stricter lending regulations across different regions pose challenges for financial institutions in structuring loan products.

- Market Saturation and Competition – An influx of lenders in the motorcycle loan market results in pricing pressure and profitability concerns.

Dominating Region

Asia Pacific leads the global motorcycle loan market, with countries like India and China witnessing high demand for two-wheelers. Rapid urbanization and a growing middle class contribute to the region’s dominance in the market.

𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐏𝐃𝐅 𝐒𝐚𝐦𝐩𝐥𝐞 𝐂𝐨𝐩𝐲 𝐨𝐟 𝐑𝐞𝐩𝐨𝐫𝐭: (𝐈𝐧𝐜𝐥𝐮𝐝𝐢𝐧𝐠 𝐅𝐮𝐥𝐥 𝐓𝐎𝐂, 𝐋𝐢𝐬𝐭 𝐨𝐟 𝐓𝐚𝐛𝐥𝐞𝐬 & 𝐅𝐢𝐠𝐮𝐫𝐞𝐬, 𝐂𝐡𝐚𝐫𝐭) @

👉

https://www.marketinsightsresearch.com/request/download/9/56291/Motorcycle-Loan-Market

Fastest-Growing Region

South America is emerging as the fastest-growing region due to increasing motorcycle sales and improved access to financing solutions.

Key Market Drivers

- Economic Growth & Higher Disposable Income – Rising income levels enable consumers to afford motorcycles through financing options.

- Flexible Loan Tenure & Interest Rates – Competitive financing solutions cater to different consumer segments, enhancing market penetration.

- Government Initiatives for Vehicle Financing – Policies promoting affordable credit for vehicle ownership drive loan uptake.

𝗕𝘂𝘆 𝗡𝗼𝘄 𝗟𝗮𝘁𝗲𝘀𝘁 𝗘𝗱𝗶𝘁𝗶𝗼𝗻 𝗼𝗳 Global Motorcycle Loan Market

https://www.marketinsightsresearch.com/report/buy_now/9/56291/Motorcycle-Loan-Market

Segmental Insights

- Type – New motorcycles dominate the market due to continuous technological advancements and enhanced consumer preference for the latest models.

- Provider – NBFCs are gaining traction as they offer flexible loan structures compared to traditional banks.

- Tenure – Loans with a tenure of more than three years are becoming popular due to lower monthly installments.

- Percentage of Amount Sanctioned – Loans covering more than 50% of the motorcycle’s cost are preferred, making ownership more accessible.

Recent Developments

- Mitsubishi UFJ Financial Group acquired Mandala Multifinance, an Indonesian motorcycle financing firm, expanding its footprint in the sector.

- Suzuki Motorcycle India partnered with Bajaj Finance to enhance financing options for customers, simplifying the loan application process.

𝗚𝗲𝘁 𝟭𝟬-𝟮𝟱% 𝗗𝗶𝘀𝗰𝗼𝘂𝗻𝘁 𝗼𝗻 𝗜𝗺𝗺𝗲𝗱𝗶𝗮𝘁𝗲 𝗽𝘂𝗿𝗰𝗵𝗮𝘀𝗲

https://www.marketinsightsresearch.com/request/discount/9/56291/Motorcycle-Loan-Market

Conclusion

The global motorcycle loan market is poised for robust growth, driven by technological advancements, financial innovation, and rising demand for two-wheelers. As lenders continue to adapt to market dynamics, motorcycle financing will remain an essential component in vehicle ownership, ensuring accessibility and affordability for consumers worldwide.

Meta Description: Global motorcycle loan market forecast (2018-2028) with trends, CAGR, key players, and regional growth insights.

Tags: motorcycle loan market, global industry trends, financing solutions, market growth, Asia Pacific, electric motorcycles, NBFCs, economic impact, loan tenure, digital lending