Membrane Bioreactor (MBR) Market size was estimated at USD 3.98 Billion in 2024 and is expected to reach USD 9.56 Billion by 2035, growing at a CAGR of 10.45% during the forecast period of 2025-2035.

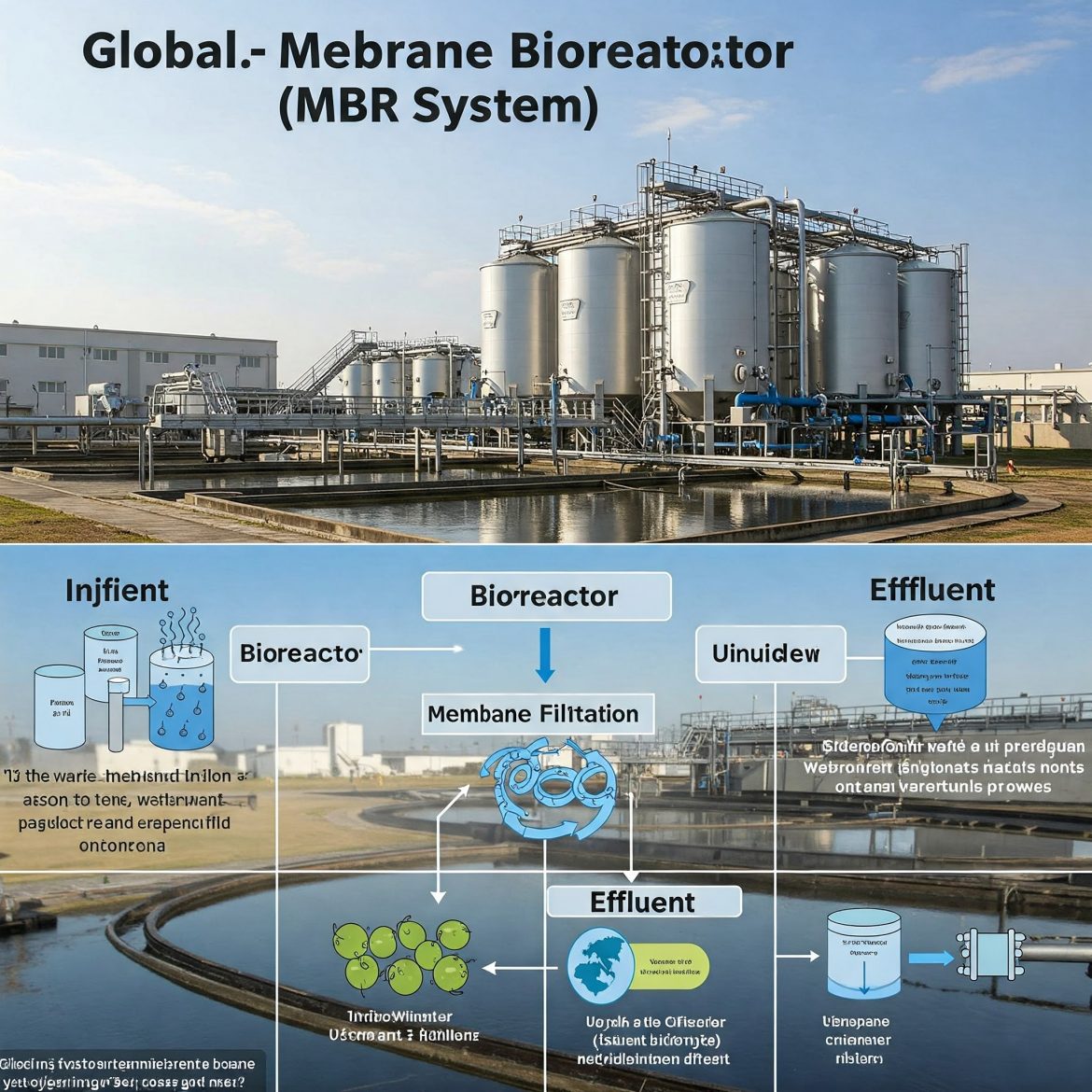

A Membrane Bioreactor or MBR is a technology that integrates membrane filtration with biological treatment of wastewater. It comprises a bioreactor in which the pollutants are decomposed by microorganisms, and a membrane module that segregates treated water from biomass with the passage of pure water.

MBR technology is used extensively in municipal and industrial wastewater treatment because it is highly efficient and has a small footprint.

It is used in processes where tight discharge specifications are needed, e.g., for the treatment of sewage, industrial effluent, and food and beverage processing wastewater.

MBR processes are also used in water re-use schemes, offering high-quality effluent that can be reused for irrigation, industrial purposes, or even drinking purposes after further treatment

Get a complimentary sample report

https://www.marketinsightsresearch.com/request/download/9/36823/Membrane-Bioreactor-MBR-Market

North America

North America is leading the Membrane Bioreactor (MBR) market. There is widespread adoption of advanced technologies and innovations in wastewater treatment due to robust research and development activities and a concern for improving operational efficiency. The U.S. Environmental Protection Agency (EPA) has established stringent water quality standards under the Clean Water Act. For instance, the National Pollutant Discharge Elimination System (NPDES) permit program regulates point sources that release pollutants into U.S. waters.

Heavy investments are provided for wastewater treatment projects and infrastructure by both public and private sources. This also involves investment in the upgrade of existing plants and the creation of new projects using MBR technology. The Water Environment Research Foundation (WERF) in the United States has sponsored several MBR technology-related projects. For example, they supported a project on “Membrane Bioreactor Process Optimization” in 2022.

Stricter environmental regulations and policies to ensure better water quality and sustainable approaches drive the deployment of sophisticated treatment technologies such as MBRs. For example, Koch Separation Solutions released a new MBR product platform in January 2024 centered on modular technology for simpler installation and maintenance within municipal and industrial applications.

Asia Pacific

Asia-Pacific is seeing high growth within the MBR market. The Asia-Pacific MBR market, which was worth USD 1.2 Billion in 2023, is anticipated to grow to USD 2.1 Billion by 2028, with a CAGR of 11.8%, a notable rise above the global average., fueled by growing urbanization, industrialization, and water scarcity in nations like China, India, and Japan. The 14th Five-Year Plan (2021-2025) aimed at enhancing the wastewater treatment rate to 95% in urban regions and 40% in rural regions by 2025.

Government initiatives towards wastewater management, increased industrial activities, and investments in the development of infrastructure are the prominent drivers propelling the growth of the MBR market in the region. For example, Mitsubishi Electric released in January 2024 a new MBR system that is optimized for decentralized treatment of wastewater in rural areas in developing Asian countries.

Key Companies:

- SUEZ: (MBR ZeeWeed technology)

- Kubota Corporation: (Kubota MBR Membrane Units)

- Evoqua Water Technologies LLC: (MemPulse MBR system)

- Mitsubishi Chemical Corporation: (STERAPORE MBR Membrane Modules)

- TORAY INDUSTRIES, INC.: (Toray Membranes for MBR)

- CITIC Envirotech Ltd.: (Memstar MBR system)

- Koch Separation Solutions” (PURON MBR Modules)

- ALFA LAVAL: (MBR Membranes and Solutions)

- Veolia: (Biostyr and AnoxKaldnes MBBR)

- Aquatech International LLC: (BioMOD MBR systems)

- GEA Group: (MBR Filtration Systems)

- Pentair:(X-Flow MBR Membranes)

- Hitachi Zosen Corporation: (Hitachi MBR Systems)

- HUBER SE: (Membrane Filtration Systems for MBR)

- Siemens AG: (MBR Solutions for Industrial and Municipal Wastewater)

- Hydranautics (Nitto Group): (Hydranautics Membranes for MBR)

- GE Water & Process Technologies: (ZeeWeed Membrane Bioreactor Systems)

- Ovivo: (Ovivo MBR technology)

- Degremont Technologies: (SUEZ) (Ultrafiltration and Membrane Bioreactor Systems)

- LG Chem: (LG Water Solutions for MBR)

Membrane Bioreactor (MBR) Market, By Configuration

Submerged MBR

Side-Stream MBR

External MBR

By Configuration, the Global Membrane Bioreactor (MBR) Market is divided into Submerged MBR, Side-Stream MBR, and External MBR. Submerged MBR systems are the largest segment of membrane bioreactor (MBR) market because they are simple, efficient, and effective in supplying continuous filtration with low operational complexity. On the other hand, Side-Stream MBR systems are the fast-growing segment due to their capability to treat high solids concentrations and enhance overall system performance. The flexibility and improved filtration capacity of Side-Stream MBR systems are in greater demand for advanced wastewater treatment applications, leading to their fast growth in the market.

Membrane Bioreactor (MBR) Market, By Membrane Type

Polymeric Membranes

Ceramic Membranes

Flat Sheet Membranes

Hollow Fiber Membranes

On the basis of Membrane Type, the Global Membrane Bioreactor (MBR) Market is segmented into Polymeric Membranes, Ceramic Membranes, Flat Sheet Membranes, and Hollow Fiber Membranes. Polymeric membranes are the leading segment in the membrane bioreactor (MBR) market because they are cost-effective, versatile, and used extensively in municipal as well as industrial applications. But Ceramic Membranes are the fast-growing segment, led by their higher durability, chemical resistance, and longer life over polymeric membranes. The growing need for high-performance and low-maintenance solutions in harsh environments is driving the use of ceramic membranes, and hence they are a major growth area in the market.

Membrane Bioreactor (MBR) Market, By Application

Municipal Wastewater Treatment

Industrial Wastewater Treatment

Water Reuse

Sludge Thickening and Dewatering

On the basis of Application, the Global Membrane Bioreactor (MBR) Market is segmented into Municipal Wastewater Treatment, Industrial Wastewater Treatment, Water Reuse, Sludge Thickening and Dewatering. Municipal wastewater treatment is the leading segment in the membrane bioreactor (MBR) market because it is widely used in cities for sewage treatment and complying with strict environmental regulations. Yet, Water Reuse is the fastest-growing segment, prompted by growing concerns regarding water scarcity and the augmented demand for water management solutions based on sustainability. The emphasis on reusing and recycling treated water in municipal as well as industrial applications is spurring the deployment of MBR technologies, positioning water reuse as a prominent area of growth within the market.

Membrane Bioreactor (MBR) Market, By Geography

North America

Europe

Asia Pacific

Rest of the World

On the basis of Geography, the Global Membrane Bioreactor (MBR) Market is segmented into North America, Europe, Asia Pacific, and the Rest of the World. In the membrane bioreactor (MBR) market, North America is the leading region, fueled by sophisticated technological infrastructure, high investments in wastewater treatment technologies, and strict regulatory requirements encouraging sustainable water management. On the other hand, the Asia Pacific region is the fast-growing segment, driven by fast urbanization, rising industrial activities, and rising environmental consciousness. The growing infrastructure projects in the region and increased emphasis on effective wastewater treatment solutions are driving the growth of MBR technologies.

Buy Full Research Report on Membrane Bioreactor Market 2025-2035 @

https://www.marketinsightsresearch.com/report/buy_now/9/36823/Membrane-Bioreactor-MBR-Market

Global Membrane Bioreactor (MBR) Market Key Developments

In February 2023, SUEZ Water Technologies & Solutions released a new high-performance MBR system for municipal wastewater treatment. The system has improved membrane filtration technology to increase efficiency and lower operating costs.

In May 2023, Veolia Water Technologies released its new MBR solution with an advanced membrane module that has enhanced fouling resistance and longer durability, designed to maximize industrial wastewater treatment processes.

In August of 2023, Xylem Inc. released its new MBR technology that combines AI-based monitoring and control systems with real-time analytics to optimize system performance and produce high-quality effluent.

In October 2023, Koch Industries launched a next-generation MBR system based on new membrane materials that provide better permeability and lower maintenance needs, intended for use in both municipal and industrial applications.