Electronic Warfare Market Size

Electronic Warfare Market accounted for USD 30.9 billion in 2023 and is projected to follow a CAGR of more than 4% during 2024-2032.

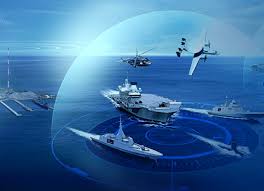

fostered by the convergence of electronic warfare with other domains including air, land, sea, and space, as well as continued military modernization efforts across the globe. Countries are spending extensively in terms of modernizing their militaries, including next-generation electronic warfare systems capable of operating smoothly in multiple domains. Such convergence increases operating capability and propels the demand for advanced electronic warfare solutions, driving market growth

| 𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐅𝐫𝐞𝐞 𝐒𝐚𝐦𝐩𝐥𝐞 𝐏𝐃𝐅 (Enter Corporate Email ID’ for a Free Sample Report): https://www.marketinsightsresearch.com/request/download/6/97/Electronic-Warfare-Market |

Report Attribute Details

Base Year 2023

Electronic Warfare Market Size in 2023 USD 30.9 Billion

Forecast Period 2024 – 2032

Forecast Period 2024 – 2032 CAGR 4%

2032 Value Projection USD 44.8 Billion

Historical Data for 2021 – 2023

No. of Pages 260

Tables, Charts & Figures 300

Segments covered Platform, Product, Frequency and End User

Growth Drivers:

Rising defense budgets and continuing modernization programs

Shifting threat environment, defined by the spread of sophisticated radar systems

Merging of electronic warfare systems with network-centric warfare principles

Electronically accelerated electronic warfare technologies

Pitfalls & Challenges

Increased complexity and interconnectivity of electronic warfare systems

Stringent regulatory regimes and export controls applicable to export and transfer of electronic warfare technologies

Electronic Warfare Market Trends

The confluence of AI and ML, and the blending of cyber and electronic warfare, drove the electronic warfare market. AI facilitates advanced autonomous decision-making in electronic warfare systems, and cyber-electromagnetic activities (CEMA) interfere with the networks of enemies. The union of these brings more advanced and adaptive systems to counter emerging threats. With militaries demanding cutting-edge capabilities in spectrum dominance and network defense, the market for AI-based and cyber-integrated electronic warfare products keeps expanding.

For example, in December 2023, DISA launched the cloud-based Electromagnetic Battle Management-Joint (EMBM-J) tool, simplifying data for commanders. EMBM-J provides a common interface for planning electronic warfare.

Electronic Warfare Market Analysis

Find out more about the major segments driving this market

Segregated on the basis of platform, the market is segmented into airborne, naval and ground-based. The airborne segment leads the market in 2023 and is expected to reach over USD 18 billion by 2032. The airborne segment has made significant revenues in 2023 due to its central position in contemporary operations in the air. Airborne electronic warfare platforms provide unmatched mobility and flexibility, which are critical to addressing changing threats. The platforms deliver essential functions such as electronic countermeasures, radar jamming, and signal intelligence gathering. With countries making their air forces more advanced and focusing on airborne defense capabilities, demand for high-end electronic warfare systems within this segment is always high, fueling the market growth.

With a powerful defense sector and heavy investments in research, the United States has gained a major portion of the market. Its illustrious firms constantly innovate, creating state-of-the-art technologies such as sophisticated radar jamming and cyber warfare systems. Additionally, strategic alliances with allied countries, strong export efforts, and emphasis on research and development drive the US to the top of electronic warfare capabilities.

Apart from this, South Korea, Japan, France, Germany, the U.K., Canada, the Netherlands, the UAE, and Saudi Arabia have also acquired a significant portion of the electronic warfare market. These nations have spent significantly on sophisticated electronic warfare systems, enhancing their defense capabilities. Focusing on neutralizing emerging threats, they buy state-of-the-art technologies like radar jamming systems and signal intelligence solutions. Their leading market share reflects their focus on updating military forces and remaining at the cutting edge of electronic warfare technology.

Electronic Warfare Market Share

BAE Systems and Lockheed Martin Corporation have a strong market share of more than 26% in the market. Firms are strengthening their market presence by using innovation and strategic alliances. Through extensive research and development, these companies launch innovative technologies that address changing defense requirements. Moreover, strategic partnerships with defense agencies and governments across the globe allow these corporations to access fresh markets and deliver end-to-end electronic warfare solutions. By keeping themselves abreast of the latest technological developments and establishing important collaborations, these organizations are strengthening their foothold and gaining a growing share of the electronic warfare business.

In addition, greater emphasis on customer-driven strategies is pushing firms to design their products for particular military specifications. By identifying the specific needs of various military forces, such companies are creating specialized electronic warfare solutions. Such a customer-oriented strategy improves product effectiveness and helps build long-term relationships with military customers. Such initiatives enhance their market position and build confidence among customers, driving further growth in the electronic warfare market.

| Buy this Premium Research Report to explore detailed market trends – https://www.marketinsightsresearch.com/report/buy_now/6/97/Electronic-Warfare-Market |

Electronic Warfare Market Companies

Major players operating in the market are

- BAE Systems

- Boeing Company

- Elbit Systems Ltd.

- Harris Corporation

- L3Harris Technologies, Inc.

- Lockheed Martin Corporation

- Northrop Grumman

- Rheinmetall AG

- RTX

- Thales