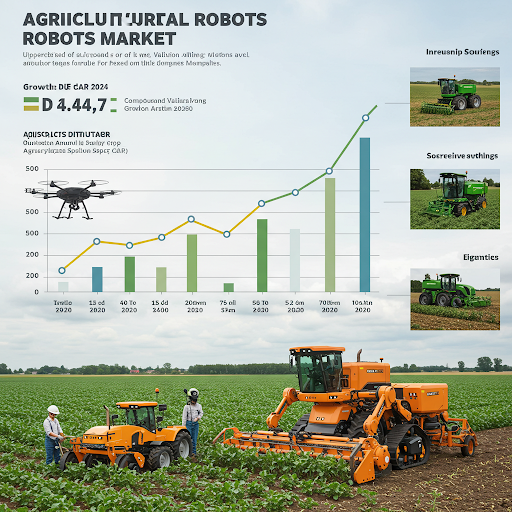

Agricultural Robots Market Size & Trends

The global size of the agricultural robots market was valued at USD 14.74 billion in 2024 and is expected to expand during the forecast period with a CAGR of 23.0% from 2025-2030.

The ever-growing demand for efficient farm management and increasing global population driving the agricultural robots market. These are projected to witness stunning growth in the years to follow. Based on United Nations estimates, the world population is projected to grow to 8.6 billion by 2030 and 9.8 billion by 2050. This population growth will significantly strain traditional food production systems to fulfill food security requirements.

Farm drones and robots are becoming game-changers with precision and optimization capabilities that enhance farming practices exponentially. Furthermore, the growing population and migration of rural to urban youth have resulted in fewer farm laborers being available. To fill the gap, agricultural robots are used to fill the gap in labor by automating tasks and reducing dependency on manual labor. With rising demand for cost-effective and efficient labor resources, the agricultural robot market is likely to expand significantly.

Farm robots with advanced sensors and AI-driven algorithms are revolutionizing planting, harvesting, and monitoring crop health. The robots avoid labor costs, minimize resource wastage, and enhance yield with precise management. Drones, on the other hand, provide farmers with an aerial view in real-time, and therefore any issues like pests, diseases, or irrigation malfunctions can be identified early on. With the ability to cover vast spaces at high velocity, drones enable farmers to act early in prevention, which results in higher yields. As the population of the world continues to grow, effective and sustainable farming will be required more, and farm robots and drones will be the necessary tools for future agriculture practice. Their ability to optimize farm management, reduce environmental impact, and maximize productivity positions them at the top of farming innovation, and their immense growth in this sector is unavoidable.

Application Insights

The milking app segment accounted for the largest share with a 29.9% revenue in 2024. This automatic milking system helps in boosting the production of milk and reducing labor costs.

Robots for milking are designed to make milking stress-free and comfortable for the cows. Milking robots have cameras and sensors that can detect the milking animals, disinfect their udders, attach the equipment, and monitor the milking. This reduces contact with cows and eliminates discomfort and stress in milking to a large extent. Further, farm robots are also able to detect and rectify any illness or anomalies in the milk, which improves the welfare of cows. This machine would automate milking, enhance the volume of milk obtained, and reduce the cost of labor.

Type Insights

The dairy robots type accounted for a market share of 38.1% in terms of revenue in 2024 due to the increasing number of dairy farmers around the world.

As the demand for milk products keeps increasing everywhere in the world, farmers are increasingly entering the dairy farming industry to meet this increasing consumer demand. However, with this increase in dairy farming, there have been challenges, such as the need for effective and labor-saving solutions. For instance, in 2021, based on the data published by the International Dairy Federation (IDF), the global dairy sector comprises approximately 133 million dairy farms. Furthermore, the global dairy sector undergoes the annual exchange of approximately 9% of global milk production.

Giving Insights

The hardware segment dominated the market with a revenue share of 53.9% in 2024. The hardware segment is a key component of the agricultural robots market, being the backbone of these new farming technologies.

It comprises the physical components and devices such as motors, and batteries that turn robots into machines capable of performing various tasks in farms. The other reason for the hardware segment dominating is the capital-intensive technology of the components of agricultural robots. Developing and manufacturing high-quality hardware requires enormous investments in research, development, and manufacturing. The hardware components are often complex and require advanced engineering expertise, precision manufacturing processes, and rigorous quality inspections. Thus, established companies such as CLAAS KGaA mbH, GEA Group with the technical prowess and financial means to invest in hardware development hold a competitive advantage, and the hardware segment dominates.

Regional Insights

The agricultural robots market of North America comprised a significant share of around 36.4% in 2024 and is currently among the most prevailing markets.

One of the prominent reasons is the vast extent of farmland within the region. For instance, based on the statistics made public by the United States Agriculture Department in February 2022, the size of the average farm in 2021 stood at 445 acres, a slight increase from the 444 acres reported the year before. North America hosts some of the biggest average sizes of farmland in the globe, and their management and monitoring manually can be a very challenging and resource-intensive task. To address this challenge, farmers in North America have been among the earliest adopters of farm robots and automation systems in a bid to increase efficiency and improved harvests.

Recent Developments

In February 2024, CNH Industrial N.V. reported that it had invested in Bem Agro, a Brazilian technology startup that offers AI-based agronomic mapping solutions. The investment is to strengthen the company’s agricultural technology portfolio, particularly precision farming, by leveraging Bem Agro’s aerial imaging technology to enhance crop management, minimize herbicide application, and maximize resource allocation.

In April 2023, GEA Group Aktiengesellschaft intensified cooperation with Kerbl, a producer of livestock farming equipment. This collaboration will reinforce the company’s market presence with the GEA Exclusive Program that offers entry into new markets. With the experience of Kerbl and its distribution network, GEA Group Aktiengesellschaft intends to broaden its agricultural solutions and assist livestock farmers with cutting-edge technology.

Global Agricultural Robots Market Report Segmentation

This report projects revenue growths on global, regional, as well as country bases and provides qualitative and quantitative market trends analysis for each of the segments and sub-segments during 2017 to 2030. In this research study, Grand View Research has classified the global agricultural robots market based on application, type, offering, and region.

Application Outlook (Revenue, USD Million, 2017 – 2030)

Planting & Seeding Management

Spraying Management

Milking

Monitoring & Surveillance

Harvest Management

Livestock Monitoring

Others

Type Outlook (Revenue, USD Million, 2017 – 2030)

Driverless Tractors

UAVs

Dairy Robots

Material Management

Offering Outlook (Revenue, USD Million, 2017 – 2030)

Hardware

Software

Service

Regional Outlook (Revenue, USD Million, 2017 – 2030)

North America

U.S.

Canada

Europe

UK

Germany

France

Asia Pacific

China

India

Japan

Latin America

Brazil

Mexico

Middle East & Africa