Aerospace Riveting Equipment Market Size

Aerospace Riveting Equipment Market size was over USD 110 million in 2023 and is projected to achieve a CAGR of over 3.5% from 2024 to 2032. The increasing need for commercial and military aircraft globally is a prime driver for the aerospace riveting equipment market

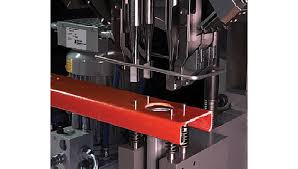

Airplane makers are experiencing a flood of orders, so they require improved equipment to accelerate assembly while producing airplanes that are safe and durable. Riveting technology has advanced significantly, with automated equipment and robots that can assemble planes faster and more accurately. Firms are spending money on new, state-of-the-art riveting machines to remain competitive and keep pace with the high-speed aerospace sector. The sector has experienced remarkable technological advancements, such as laser riveting and friction stir welding. These technological breakthroughs have transformed aircraft construction. Laser riveting employs lasers to form exact, firm connections, whereas friction stir welding welds materials together without heating them up, forging super-strong bonds.

For example, in August 2023, Bond Technologies, Inc. released the PM2 Friction Stir Welding machine, a innovative solution for large-volume production with advanced capabilities suitable for small and medium-sized aluminum alloy components, providing reliability and efficiency in tough production conditions.

| 𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐅𝐫𝐞𝐞 𝐒𝐚𝐦𝐩𝐥𝐞 𝐏𝐃𝐅 (Enter Corporate Email ID’ for a Free Sample Report): https://www.marketinsightsresearch.com/request/download/6/102/Aerospace-Riveting-Equipment-Market |

Report Attribute Details

Base Year 2023

Aerospace Riveting Equipment Market Size in 2023 USD 110 Million

Forecast Period 2024 – 2032

Forecast Period 2024 – 2032 CAGR 3.5%

2032 Value Projection USD 160 Million

Historical Data for 2018 – 2023

No. of Pages 250

Tables, Charts & Figures 351

Segments covered Equipment, type, technology, end-use, and region

Growth Drivers

Growing Aircraft Production

Focus on Lightweight Materials

Strict Safety Regulations

Technological Innovation

Growing Demand for Retrofitting and Maintenance

Pitfalls & Challenges

Technological Obsolescence

Strict Regulatory Compliance

Human-Readable Version The aerospace business has some strict rules to abide by. And if you’re producing the equipment that holds planes together with rivets, you’d better ensure it complies with those strict safety and quality standards. It’s not only a question of doing what the rules say – it’s about saving your reputation. If your equipment isn’t up to scratch, you’re going to receive some serious fines, lawsuits, and a lot of bad publicity. Not to mention, your projects will get held up, and customers will lose Vertrauen in your products. That’s why it’s so important to stay on top of the latest regulations and make sure your equipment is always up to par. You need to keep a close eye on things, check your quality control, and put safety first. By doing these things, you can avoid the dangers of not following the rules and protect your company’s good name.

Aerospace Riveting Equipment Market Trends

The aerospace sector is experiencing a shift towards more automation in production processes, such as riveting. Automated riveting systems provide better efficiency, accuracy, and repeatability, resulting in increased productivity and cost reduction. Companies are investing in robotic riveting technology and intelligent technologies to optimize production and address increasing demand. In April 2022, ISOVOLTA AG acquired Gurit Holding AG’s Aviation and Aerospace business unit. The acquisition allowed the company to diversify its business to manufacture advanced composite materials, composite manufacturing equipment, and core kitting services for the aerospace market.

Sustainability is becoming a big thing in how we build planes and rockets. We’re attempting to use things that don’t harm the environment and construct things that don’t consume a lot of energy. This includes the machines we use to put pieces of the plane together, like rivets. Companies are finding ways to make these machines use less energy, use materials that can be turned into something else later, and not make as much garbage. This is important because the aerospace industry wants to be more eco-friendly. Another neat thing that’s going on in the exciting world is that we’re utilizing more data and computers. We stick sensors on the machines to inform us how they’re performing, then we utilize that data to smooth things out. This allows us to produce better parts quicker, less downtime, and less waste.

Aerospace Riveting Equipment Market Analysis

Discover more about the most important segments contributing to this market

On the basis of equipment, the market is divided into hydraulic riveting equipment, pneumatic riveting equipment, electric riveting equipment. The hydraulic riveting equipment segment is anticipated to record a CAGR of more than 3.5% during the forecast period from 2024 to 2032. Hydraulic systems provide high force and accuracy, which makes them suitable for aerospace applications where strong and durable joints are essential. These types of systems are frequently employed in the assembly of aircraft structures such as fuselage panels, wing parts, and frames. Due to the emphasis by aerospace producers on quality, safety, and efficiency, hydraulic riveting machines remain a go-to option for producing sturdy and accurate riveted joints in the construction of commercial and military aircraft.

Hello! As of 2023, North America is splashing big onto the world market for aircraft riveting equipment. They.ve got a whopping 33% of the pie, and it’s increasing by the day. Why? Well, there’s a genuine demand for brand new planes, both for commercial airlines as well as the military. And who’s producing these planes? Giants such as Boeing, Lockheed Martin, and Northrop Grumman are hard at work right here in North America. That means they require top-of-the-line riveting equipment to keep their planes in top shape. In addition, we’re noticing some awesome developments in riveting technology. We’re thinking of new composite materials that can lighten aircraft and reinforce them. And when there are so many safety regulations in place, these aircraft must be manufactured precisely. Therefore, there is a vast requirement for equipment that will be able to work with these new materials and abide by all these standards.

Aerospace Riveting Equipment Market Share

Northrop Grumman has a large market share in the aerospace riveting equipment market. Northrop Grumman is a major market player. Although Northrop Grumman is best recognized for its capabilities in designing and producing aircraft, spacecraft, and defense systems, the company also plays a role in developing and supplying riveting equipment and associated technologies.

Leading companies like Lockheed Martin, Northrop Grumman, Parker Hannifin Aerospace, POP Aviation & Industrial, STANLEY, are continuously taking strategic steps like geographical expansion, acquisitions, mergers, partnerships, collaborations, and product or service introductions.

| Buy this Premium Research Report to explore detailed market trends – https://www.marketinsightsresearch.com/report/buy_now/6/102/Aerospace-Riveting-Equipment-Market |

Aerospace Riveting Equipment Market Companies

Major players operating in the aerospace riveting equipment industry are

- Airbus Helicopters

- Avdel

- Boeing Commercial Airplanes

- Cherry Aerospace

- Eaton Aerospace

- GESIPA Aerospace

- Henrob

- Huck Aerospace

- Lockheed Martin

- Northrop Grumman

- Parker Hannifin Aerospace

- POP Aviation & Industrial

- PSM Aerospace

- STANLEY Engineered Fastening (SENCO)