Missile Guidance System Market Size

Missile Guidance System Market size was worth USD 925 million in 2023 and is expected to grow at a CAGR of more than 5% from 2024 to 2032. The increasing emphasis on missile technology development is fueling the market for missile guidance systems. Guidance technologies are continuously refined to enhance the precision and reliability of missile strikes. This involves the creation of Inertial Navigation Systems (INS), Global Positioning Systems (GPS), laser guidance systems, and terminal homing guidance systems

The convergence of these technologies allows missiles to fly accurately to target coordinates, correct trajectory in flight, and hit moving targets with accuracy. For example, in June 2022, Elbit System demonstrated the Range Extension & Smart Tail (REST) kit for air-to-surface warheads at Eurosatory 2022 as part of its range of precision munitions. The REST kit delivers all-weather pinpoint ‘fire and forget’ on ranges of up to 120km and has the facility for a steep impact angle to gain increased penetration of hard targets.

| 𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐅𝐫𝐞𝐞 𝐒𝐚𝐦𝐩𝐥𝐞 𝐏𝐃𝐅 (Enter Corporate Email ID’ for a Free Sample Report): https://www.marketinsightsresearch.com/request/download/6/101/Missile-Guidance-System-Market |

Missile Guidance System Market Report Attributes

Report Attribute Details

Base Year 2023

Missile Guidance System Market Size in 2023 USD 925 Million

Forecast Period 2024 to 2032

Forecast Period 2024 to 2032 CAGR 5%

2032 Value Projection USD 1.4 Billion

Historical Data for 2018 – 2023

No. of Pages 220

Tables, Charts & Figures 252

Segments included\tLaunch platform, guidance system, end user

Growth Drivers\t

Technological advancements in missiles

Emphasis on precision strike capabilities

Increased demand for multi-layered defence architectures

Increased emphasis on homeland defence

Growing defence spending

Pitfalls & Challenges\t

Budget and cost pressures

Technological complexity

Missile Guidance System Market Trends

Defense agencies across the globe are investing more in military modernization initiatives to enhance their weapon systems and capabilities to ensure strategic superiority and meet the changing security threats. Consequently, sophisticated guided munitions that provide greater lethality, versatility, and reliability are becoming popular. For example, in June 2021, Saab AB, in collaboration with the U.S. Army and Raytheon Missiles & Defense, successfully tested the new Guided Multipurpose Munition (GMM). This allowed the defense to precisely target and engage different threats such as armored vehicles, buildings, bunkers, and troops.

The incorporation of missile systems within network-centric warfare frameworks allows unhesitant communication, coordination, and interoperability with other weapon platforms, sensors, and control assets. Network-centric warfare integration boosts situational awareness, responsiveness, and effectiveness in missile operations by taking advantage of real-time shared data and collaborative engagement features. For example, in June 2021, Rafael Advanced Defense Systems Ltd. introduced Sea Breaker, the fifth-generation long-range, autonomous, precision-guided missile system, which allows for substantial attack performance on a range of high-value maritime and land targets.

Missile Guidance System Market Analysis

Discover more about the most significant segments influencing this market

Following the guidance system, the market has been divided into command guidance system, beam rider guidance system, homing guidance system, and inertial guidance system. In 2023, the share of the market for the beam rider guidance system was 45%.

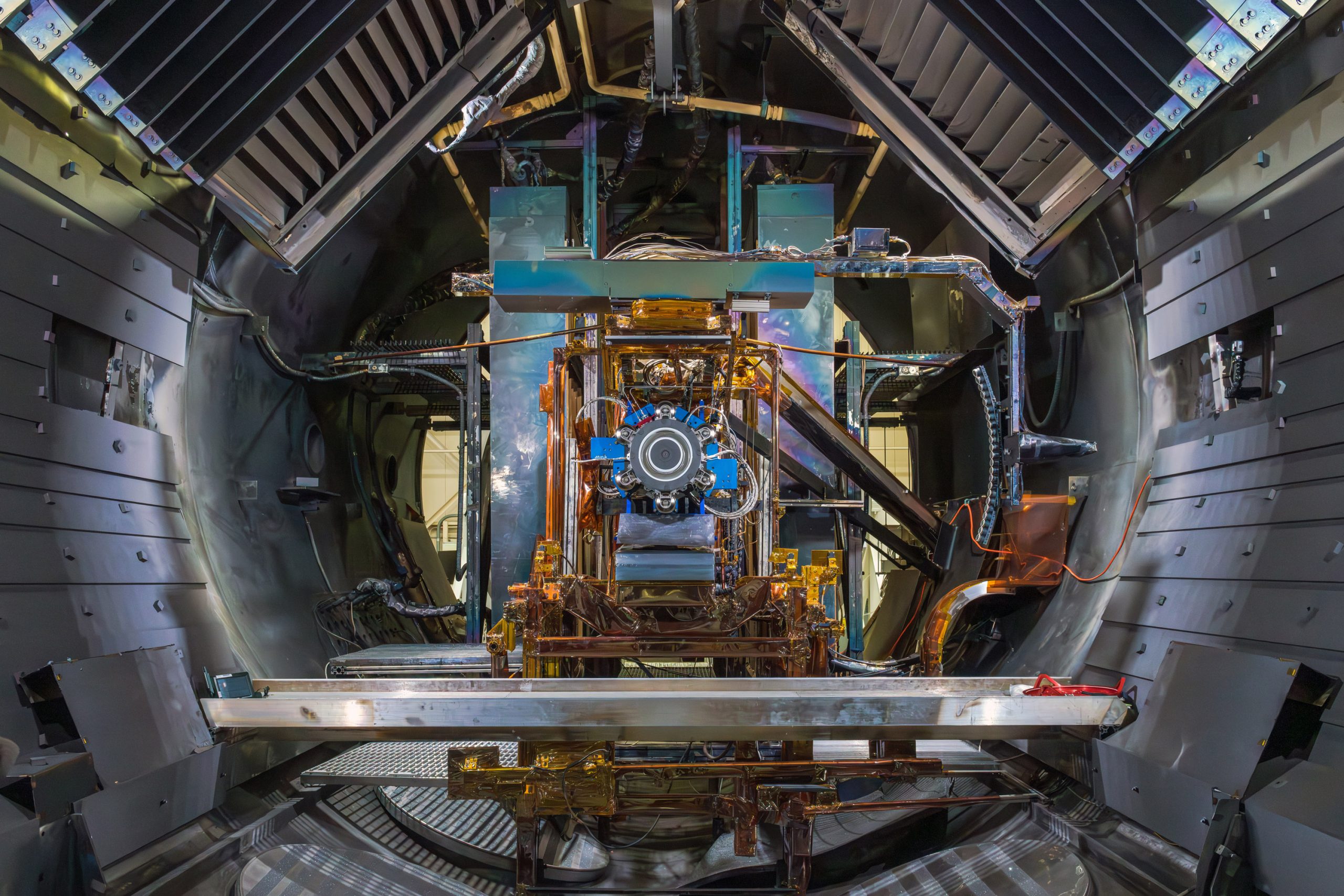

The advancing beam rider guidance systems are also being incorporated in new missile platforms and weapon systems to enhance their functionality and give them an alternate means of guidance. Combinations of beam rider technology with third-generation missile platforms provide flexibility to engagement situations and increase the general operational flexibility of the weapon platform. For example, in February 2023, Thales and Bharat Dynamics Limited (BDL), a Government of India undertaking, signed a Memorandum of Understanding (MoU) for establishment of manufacturing plants in India for precision-strike 70mm laser-guided rockets. The command guidance system employed here is utilized to light up the target location with laser energy. The missile, which has a laser seeker or sensor installed, picks up and locks onto the laser spot, enabling accurate targeting and attack.

Missile Guidance System Market Share

Thales Group is a world leader in aerospace, defense, and security technologies with a broad portfolio of products and solutions, such as missile guidance systems. It has a long tradition in the defense sector and an excellent reputation for innovation and dependability and contributes to the development, production, and integration of sophisticated missile guidance systems for military use around the globe.

Boeing, an international aerospace, and defense company, is an important player in the missile guidance system market through its wide-ranging portfolio of defense products and services. As a top defense contractor in the world, Boeing utilizes its knowledge of aerospace technologies, systems integration, and precision-guided munitions to design and provide sophisticated missile guidance systems for military use around the globe.

| Buy this Premium Research Report to explore detailed market trends – https://www.marketinsightsresearch.com/report/buy_now/6/101/Missile-Guidance-System-Market |

Missile Guidance System Market Companies

Major companies operating in the missile guidance system industry are

- Thales

- Boeing

- Lockheed Martin Corporation

- Elbit Systems Ltd.

- General Dynamics Mission Systems, Inc.

- Raytheon Technologies (RTX)

- BAE Systems

- Honda Motor Co., Ltd.