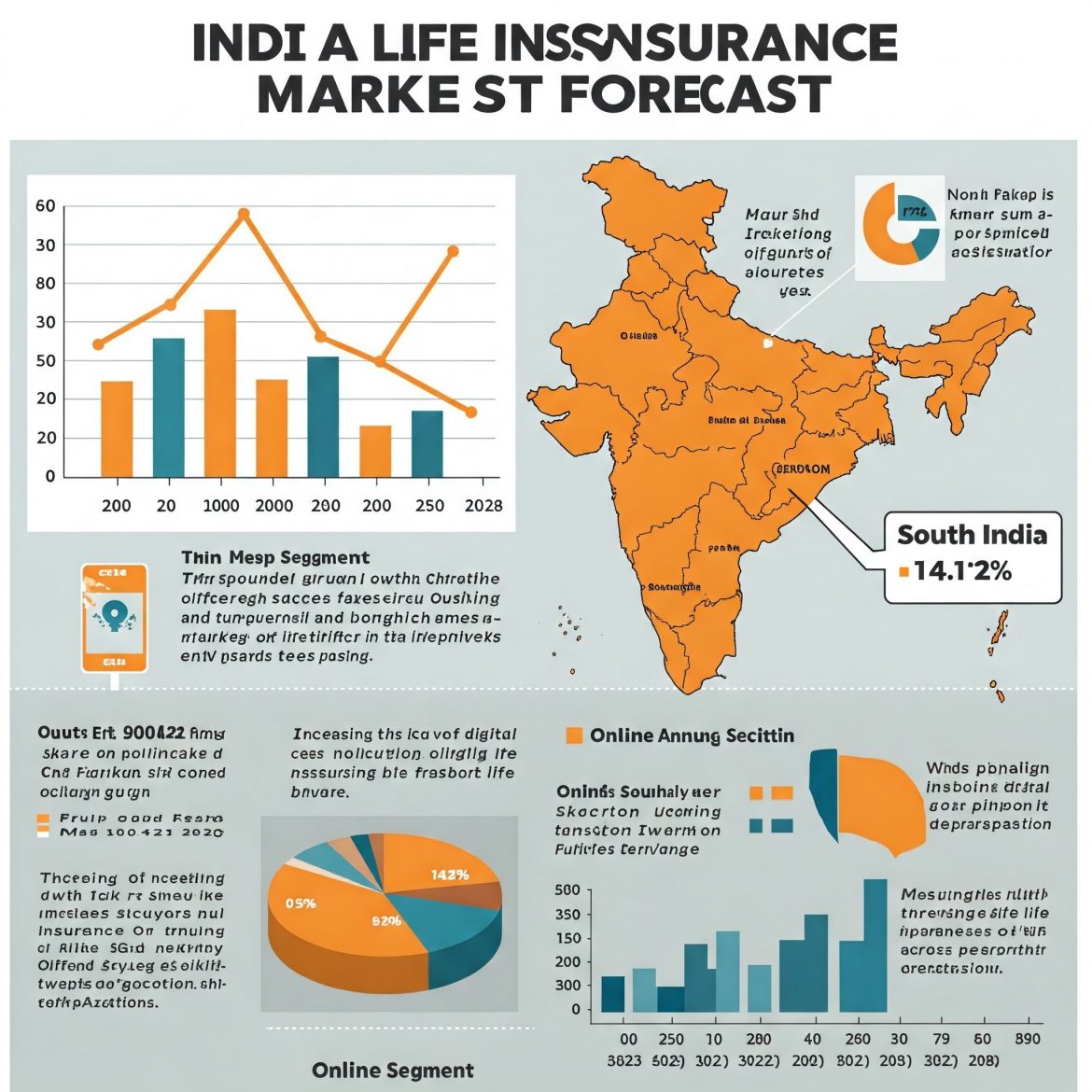

The India life insurance market is poised for remarkable growth, projected to expand at a CAGR of 14.12% from 2023 to 2029. Valued at USD 100.42 billion in 2023, the market is expected to experience substantial expansion, driven by rising awareness, digital adoption, and a shift in consumer preferences towards comprehensive insurance plans.

Market Trends

The sector is evolving rapidly, fueled by advancements in materials, recycling technologies, and shifting consumer preferences. The industry has witnessed a surge in digitalization, with insurers leveraging AI and data analytics to offer personalized plans. The rise of Unit-Linked Insurance Plans (ULIP) and term insurance policies further reflects the changing consumer inclination towards high-return and protection-oriented products.

Additionally, the penetration of online insurance sales has transformed the market, making it easier for customers to purchase policies with enhanced transparency. The growing focus on financial security post-COVID-19 has also amplified demand, leading to increased policy adoption across various income groups.

𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐏𝐃𝐅 𝐒𝐚𝐦𝐩𝐥𝐞 𝐂𝐨𝐩𝐲 𝐨𝐟 𝐑𝐞𝐩𝐨𝐫𝐭: (𝐈𝐧𝐜𝐥𝐮𝐝𝐢𝐧𝐠 𝐅𝐮𝐥𝐥 𝐓𝐎𝐂, 𝐋𝐢𝐬𝐭 𝐨𝐟 𝐓𝐚𝐛𝐥𝐞𝐬 & 𝐅𝐢𝐠𝐮𝐫𝐞𝐬, 𝐂𝐡𝐚𝐫𝐭) @

👉

https://www.marketinsightsresearch.com/request/download/9/56300/India-Life-Insurance-Market

Market Challenges

Despite promising growth, the industry faces hurdles, including high distribution costs, which make policies expensive for lower-income groups. Additionally, complex product portfolios create confusion among consumers, limiting widespread adoption. Rural penetration remains a challenge, as insurers struggle to extend services to underserved areas due to limited financial literacy and accessibility.

Dominating Region

The North region leads the India life insurance market, primarily due to the government’s mandatory coverage for employees and a growing middle-class population. Increased policy awareness and digital accessibility further contribute to the dominance of this region.

𝗕𝘂𝘆 𝗡𝗼𝘄 𝗟𝗮𝘁𝗲𝘀𝘁 𝗘𝗱𝗶𝘁𝗶𝗼𝗻

https://www.marketinsightsresearch.com/report/buy_now/9/56300/India-Life-Insurance-Market

Fastest-Growing Region

The South region is emerging as the fastest-growing segment, driven by increased urbanization, higher disposable income, and rising digital adoption. Insurers are expanding their footprints in Tier 2 and Tier 3 cities, leveraging technology to bridge the accessibility gap.

𝗚𝗲𝘁 𝟭𝟬-𝟮𝟱% 𝗗𝗶𝘀𝗰𝗼𝘂𝗻𝘁 𝗼𝗻 𝗜𝗺𝗺𝗲𝗱𝗶𝗮𝘁𝗲 𝗽𝘂𝗿𝗰𝗵𝗮𝘀𝗲

https://www.marketinsightsresearch.com/request/discount/9/56300/India-Life-Insurance-Market

Market Growth Drivers

Several factors contribute to the booming India life insurance market:

- Growing Middle-Class Population: With rising income levels, individuals seek financial security through life insurance.

- Government Initiatives: Regulatory support from IRDAI has fostered a competitive and consumer-friendly market.

- Technological Advancements: AI-driven customer engagement, paperless policy issuance, and data analytics enhance the insurance experience.

- Increased Awareness: A shift in mindset towards financial planning has accelerated policy adoption.

Recent Developments

- April 2023: Canara HSBC Life Insurance introduced Smart Guaranteed Pension, a flexible annuity product ensuring lifelong income security.

- November 2022: LIC launched New Jeevan Amar & Tech Term, offering fixed premium and guaranteed returns.

- October 2022: LIC unveiled Dhan Varsha, a policy providing both financial security and guaranteed maturity benefits.

Market Opportunities

The India life insurance market presents lucrative opportunities for insurers to innovate and expand their offerings. Digital transformation is unlocking new customer segments, while the rising demand for customized financial protection plans fuels market expansion.

As insurers continue to integrate advanced technologies and flexible premium structures, the sector is set to witness sustained growth, making life insurance an essential financial asset for millions in India.