Market Overview

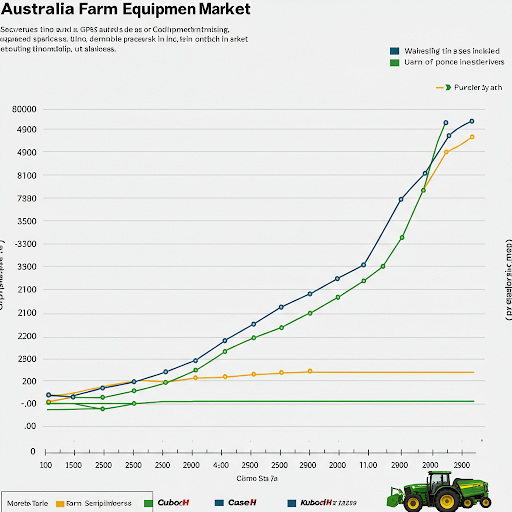

Australia Farm Equipment Market was worth USD 586.25 million in 2023 and is expected to register consistent growth during the forecast period with a CAGR of 4.24% from 2023 to 2029.

The government of Australia has been actively promoting the shift towards cleaner energy in agriculture. As per the Department of Agriculture, Fisheries and Forestry (DAFF), Australia has pledged to cut greenhouse gas emissions by 43% by 2030, and sustainable agriculture is central to meeting this goal. Tractors powered by biofuels and other renewable fuels assist in meeting these objectives by reducing emissions while providing long-term cost savings for farmers. This transition is also accompanied by local production of biofuels, which diversifies farming activities and opens up new revenue streams for farmers who produce fuels.

| 𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐅𝐫𝐞𝐞 𝐒𝐚𝐦𝐩𝐥𝐞 𝐏𝐃𝐅 (Enter Corporate Email ID’ for a Free Sample Report):https://www.marketinsightsresearch.com/request/download/29/55710/australia-farm-equipment-market |

The Australian Farm Equipment Market is ready to experience dramatic growth in the near future. Driven by advances in technology, a change in paradigm towards eco-friendly approaches, and the growing need for agricultural commodities, the market is going in the right direction. With more investments flowing into this industry, it is projected that the market will experience more innovations that will transform methods of farming and enhance the sustainability and profitability of the farm sector.

Key Market Players

- Farm Tech Machinery Pty Ltd

- AF Gason Pty Ltd

- Briggs & Stratton Australia Pty Limited

- PFG Australia Pty Ltd

- Silvan Australia Pty Ltd

- AGCO Australia

- John Deere Australia

- Kubota Australia Pty Ltd

- CNH Industrial Australia Pty Limited

- Kuhn Australia Pty Ltd

| By Type | By Application | By Region |

|

|

|

Key Market Drivers

Rising Need for Precision Agriculture Solutions

Precision farming, otherwise known as precision agriculture, is a sophisticated methodology leveraging the latest technology and equipment to maximize the efficiency and productivity of farm works. It includes the use of GPS technology, automated systems, and other advanced equipment, which empowers farmers to carry out duties with hitherto unimagined precision and effectiveness.

A central element of precision farming is the use of tractors, which are key assets enabling precision farming practices. These heavy-duty machines are a vital requirement for a variety of farming activities, delivering the necessary power and flexibility required for modern-day agricultural operations. The increasing demand for tractors in the Australian equipment market reflects the central role and significance of precision farming practices.

The spread of automation in agriculture is a major driver fueling the expansion of the farm equipment market. The development of autonomous farming solutions has transformed conventional farming practices, ranging from semi-automated technologies with minimal operator interaction to fully autonomous systems that can function independently. This range of automation solutions provides farmers with greater flexibility and efficiency in their operations, fueling increased innovation in the agricultural sector.

The coming together of breakthrough technologies is revolutionizing the farm sector, fueling economic growth and changing centuries-old farming techniques. With the sudden rise of precision farming, the farm equipment market in Australia is also expected to experience steady expansion, serving the country’s changing needs of farmers and the pursuit of sustainable and effective farming techniques.

Segmental Insights

Application Insights

The land development & seed bed preparation segment is expected to witness high growth over the forecast period.

With the uncertainty of climate cycles, characterized by uneven rainfall, extended droughts, and unusual weather events, timely and efficient land and seedbed preparation must be undertaken by farmers. Optimizing these preparation processes helps farmers mitigate the adverse impacts of climate variability on crop yields and farm productivity.

Regional Insights

Australia Capital Territory & New South Wales became the market leader in the Australia Farm Equipment Market in 2023, with the highest market value share.

From the green fields of crop farming to the large pastures for animal rearing, NSW has a thriving agricultural industry defined by its diverse farming practices. Not only does this diverse agriculture support the region’s agricultural prosperity but also create high demand for different kinds of farm machinery, designed to serve the unique needs of each type of farming.

| Buy this Premium Research Report to explore detailed market trends –https://www.marketinsightsresearch.com/report/buy_now/29/55710/australia-farm-equipment-market |

Recent Developments

In February 2024, Steiger unveiled its most resilient tractor model in Australia for use during the 2025 crop season. The 715 Quadtrac boasts a number of enhancements, among them a rebuilt heavy-duty undercarriage with an extended track configuration to enhance traction and flotation, complementing the tractor’s high horsepower. Even though longer in length, the tractor continues to maintain its ability to reduce soil compaction while delivering extra power to the ground. Fitted with an FPT 16-liter TST (twin-stage-turbo) Tier 2 engine, the 715 model has a 23% bigger displacement than its predecessor, the 13-liter engine, which translates into increased power and torque.