Introduction

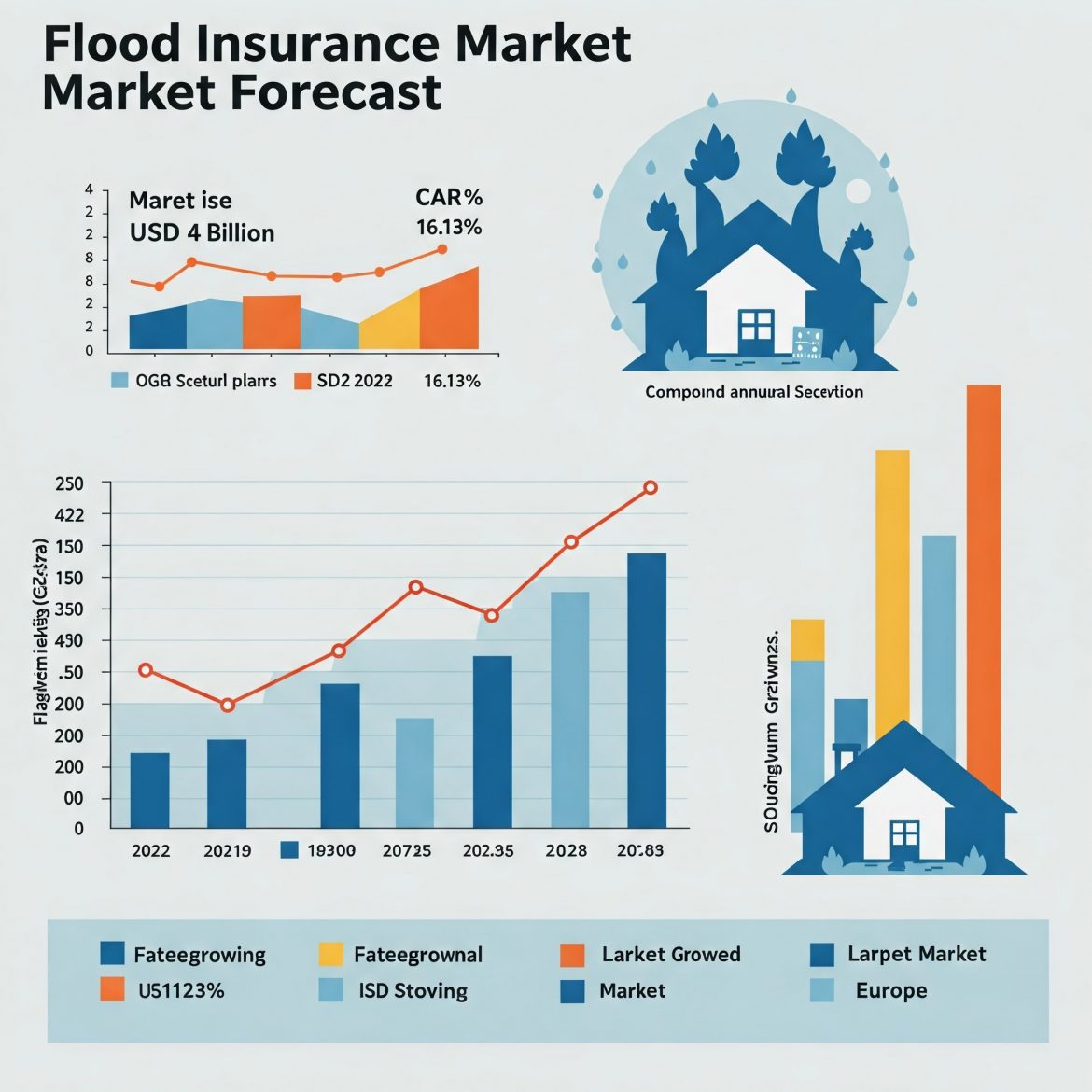

The global flood insurance market was valued at USD 13.4 billion in 2022 and is projected to grow at a CAGR of 16.13% from 2023 to 2028. Increasing climate change-related flooding, rising urbanization, and the need for financial protection against property damage are driving this market.

Market Trends

- Climate Change Impact: Extreme weather patterns and rising sea levels increase flood risks, boosting demand for building property and personal contents coverage.

- Government Regulations & Public-Private Partnerships: Many governments are enforcing flood insurance mandates, while insurers collaborate with public institutions for risk-sharing.

- Technological Advancements: AI-driven flood risk assessment and real-time analytics improve policy pricing and claims processing.

- Expansion into Emerging Markets: More insurers are entering flood-prone regions in Asia-Pacific, Latin America, and Africa.

- Parametric Insurance Adoption: Quick payouts based on predefined flood levels enhance claim efficiency and customer satisfaction.

𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐏𝐃𝐅 𝐒𝐚𝐦𝐩𝐥𝐞 𝐂𝐨𝐩𝐲 𝐨𝐟 𝐑𝐞𝐩𝐨𝐫𝐭: (𝐈𝐧𝐜𝐥𝐮𝐝𝐢𝐧𝐠 𝐅𝐮𝐥𝐥 𝐓𝐎𝐂, 𝐋𝐢𝐬𝐭 𝐨𝐟 𝐓𝐚𝐛𝐥𝐞𝐬 & 𝐅𝐢𝐠𝐮𝐫𝐞𝐬, 𝐂𝐡𝐚𝐫𝐭) @

👉https://www.marketinsightsresearch.com/request/download/9/56250/Flood-Insurance-Market

Market Challenges

- High Premium Costs: Expensive coverage deters lower-income property owners.

- Data Gaps in Risk Assessment: Inconsistent flood mapping affects underwriting accuracy.

- Underinsurance & Limited Awareness: Many homeowners lack sufficient flood protection, leaving them vulnerable.

Regional Insights

- Dominating Region: Europe leads due to strong flood risk management programs and high insurance penetration.

- Fastest-Growing Region: Asia-Pacific experiences rising demand amid increasing urbanization and climate risks.

𝗕𝘂𝘆 𝗡𝗼𝘄 𝗟𝗮𝘁𝗲𝘀𝘁 𝗘𝗱𝗶𝘁𝗶𝗼𝗻 𝗼𝗳 Flood Insurance Market 𝗥𝗲𝗽𝗼𝗿𝘁

https://www.marketinsightsresearch.com/report/buy_now/9/56250/Flood-Insurance-Market

Market Forecast & Projections (2024-2028)

| Metric | Value |

| Market Size (2022) | USD 13.4 billion |

| CAGR (2023-2028) | 16.13% |

| Fastest-Growing Segment | Commercial |

| Largest Market | Europe |

Key Players

- USAA

- AXA

- Allstate Insurance Company

- Neptune Flood

- Assurant, Inc.

- GEICO

- Tokio Marine Highland

- Berkshire Hathaway

- Chubb

𝗚𝗲𝘁 𝟭𝟬-𝟮𝟱% 𝗗𝗶𝘀𝗰𝗼𝘂𝗻𝘁 𝗼𝗻 𝗜𝗺𝗺𝗲𝗱𝗶𝗮𝘁𝗲 𝗽𝘂𝗿𝗰𝗵𝗮𝘀𝗲

https://www.marketinsightsresearch.com/request/discount/9/56250/Flood-Insurance-Market

Conclusion

The evolving with climate-driven risks, regulatory measures, and digital innovations. With a CAGR of 16.13% through 2028, insurers are enhancing policy coverage and customer accessibility to meet growing global demand.